Under Armour 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

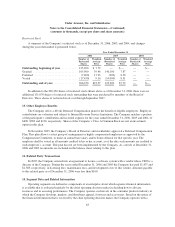

10. Mandatorily Redeemable Series A Preferred Stock

On September 30, 2003, the Company issued 1,200,000 shares of Series A Preferred Stock for $4,356 in

cash proceeds net of $133 in stock issuance costs. Holders of the Series A Preferred Stock had limited voting

rights and certain protective rights regarding major business decisions of the Company and the payment of

dividends to common stockholders. Holders of the Series A Preferred Stock did have the ability to appoint one

member to the Company’s Board of Directors.

The holders of the Series A Preferred Stock were entitled to receive cumulative preferential dividends at 8%

of the stated redemption value of $10 per share compounded annually if declared by the Board of Directors. The

Series A Preferred Stock was redeemable at the option of the holders in September 2008 at a redemption price of

$10 per share, plus 125% of accrued but unpaid dividends plus 25% of any previously declared dividends that

were not paid within 120 days after the respective year end (the “Redemption Price”). The Series A Preferred

Stock also carried a liquidation preference equal to its stated Redemption Price and could be redeemed by the

Company at any time at the then stated Redemption Price. The amount of the Redemption Price, including

issuance costs, was being accreted to the value of the Series A Preferred Stock each year. For the years ending

December 31, 2005 and 2004, $5,307 and $1,994, respectively, had been accreted to the Redemption Price of the

Series A Preferred Stock during the period.

As required, the Series A Preferred Stock was redeemed at the $10 stated value per share, or $12,000, upon

the initial public offering.

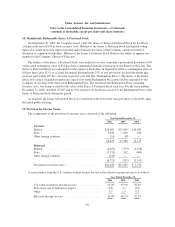

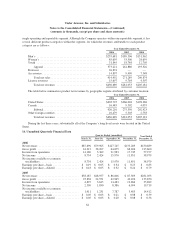

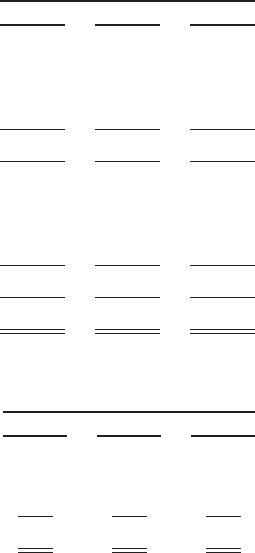

11. Provision for Income Taxes

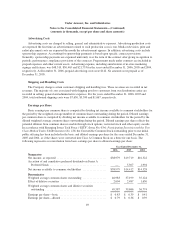

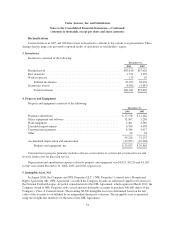

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

2006 2005 2004

Current

Federal ........................................ $24,083 $12,009 $10,485

State .......................................... 2,630 1,509 630

Other foreign countries ............................ 116 68 —

26,829 13,586 11,115

Deferred

Federal ........................................ (2,656) (573) (2,378)

State .......................................... (3,120) 242 (963)

Other foreign countries ............................ (945) — —

(6,721) (331) (3,341)

Provision for income taxes ......................... $20,108 $13,255 $ 7,774

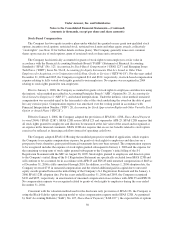

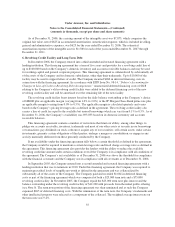

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as follows:

Year Ended December 31,

2006 2005 2004

U.S. federal statutory income tax rate ................. 35.0% 35.0% 35.0%

State taxes, net of federal tax impact ................. (1.9) 3.7 (3.2)

Other .......................................... 0.9 1.5 0.5

Effective income tax rate .......................... 34.0% 40.2% 32.3%

59