Under Armour 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

Rent expense for the years ended December 31, 2006, 2005 and 2004 was $5,389, $3,237 and $1,881,

respectively, under the operating lease agreements.

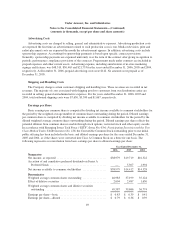

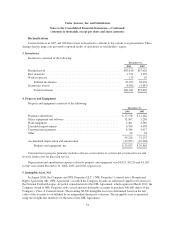

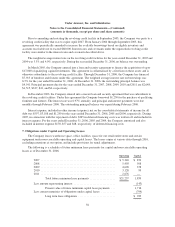

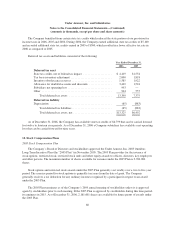

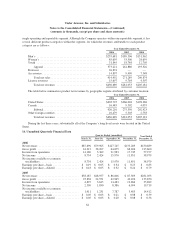

The following summarizes the Company’s assets under capital lease agreements:

December 31,

2006 2005

Office equipment .......................................... $1,494 $ 1,968

Furniture and fixtures ....................................... 29 2,106

Leasehold improvements .................................... 520 629

Plant equipment ........................................... 1,934 1,949

3,977 6,652

Accumulated depreciation and amortization ..................... (2,292) (2,653)

Property and equipment, net .............................. $1,685 $ 3,999

For the years ended December 31, 2006, 2005 and 2004, $758, $1,397 and $1,195, respectively, of depreciation

and amortization on assets under capital leases have been included in depreciation and amortization expense.

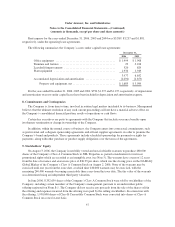

8. Commitments and Contingencies

The Company is, from time to time, involved in routine legal matters incidental to its business. Management

believes that the ultimate resolution of any such current proceedings will not have a material adverse effect on

the Company’s consolidated financial position, results of operations or cash flows.

Certain key executives are party to agreements with the Company that include severance benefits upon

involuntary termination or change in ownership of the Company.

In addition, within the normal course of business, the Company enters into contractual commitments, such

as professional and collegiate sponsorship agreements and official supplier agreements, in order to promote the

Company’s brand and products. These agreements include scheduled sponsorship fee payments or rights fee

payments, along with other purchase or product supply obligations over the terms of the agreements.

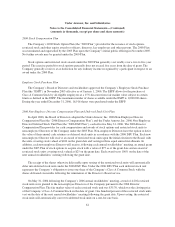

9. Stockholders’ Equity

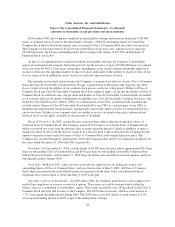

On August 3, 2006, the Company issued fully vested and non-forfeitable warrants to purchase 480,000

shares of the Company’s Class A Common Stock to NFL Properties as partial consideration for footwear

promotional rights which are recorded as an intangible asset (see Note 5). The warrants have a term of 12 years

from the date of issuance and an exercise price of $36.99 per share, which was the closing price on the NASDAQ

Global Market of the Company’s Class A Common Stock on August 2, 2006. None of the warrants may be

exercised until one year from the issue date, at which time 240,000 warrants may be exercised, with the

remaining 240,000 warrants becoming exercisable three years from the issue date. The fair value of the warrants

was determined using an independent third party valuation.

In June 2006, 8,352,639 shares of the Company’s Class A Common Stock were sold by stockholders of the

Company, including certain members of the Company’s management, pursuant to an underwritten public

offering registered on Form S-1. The Company did not receive any proceeds from the sale of the shares sold in

the offering and expenses incurred from the offering were paid by the selling stockholders. In connection with

the offering, 1,950,000 shares of Class B Convertible Common Stock were converted into shares of Class A

Common Stock on a one-for-one basis.

57