Under Armour 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

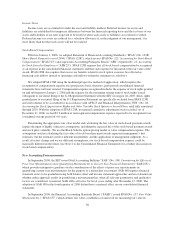

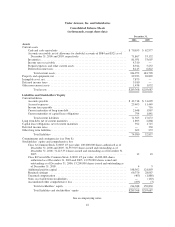

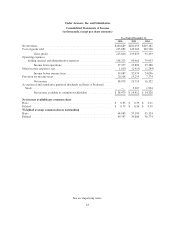

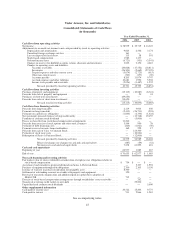

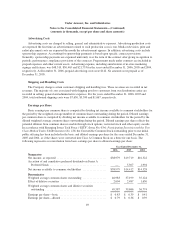

Under Armour, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(in thousands)

Year Ended December 31,

2006 2005 2004

Cash flows from operating activities

Net income ..................................................................... $38,979 $ 19,719 $16,322

Adjustments to reconcile net income to net cash provided by (used in) operating activities

Depreciationandamortization.................................................. 9,824 6,546 3,174

Unrealized foreign exchange rate loss ............................................ 161 — —

Loss on disposal of fixed assets ................................................. 115 58 591

Stock-based compensation ..................................................... 1,982 1,177 —

Deferred income taxes ........................................................ (6,721) (331) (3,341)

Changes in reserves for doubtful accounts, returns, discounts and inventories ............ 3,832 3,150 4,610

Changes in operating assets and liabilities:

Accounts receivable ...................................................... (20,828) (17,552) (18,811)

Inventories ............................................................. (26,504) (5,669) (27,195)

Prepaid expenses and other current assets ..................................... (3,674) (2,723) (615)

Other non-current assets .................................................. (323) (157) (69)

Accounts payable ........................................................ 8,203 11,074 9,747

Accrued expenses and other liabilities ....................................... 10,681 1,990 5,504

Income taxes payable and receivable ......................................... (5,026) (1,487) 1,232

Net cash provided by (used in) operating activities .......................... 10,701 15,795 (8,851)

Cash flows from investing activities

Purchase of property and equipment ................................................. (15,115) (10,887) (8,724)

Proceeds from sale of property and equipment ......................................... — 54 41

Purchases of short-term investments ................................................. (89,650) — —

Proceeds from sales of short-term investments ......................................... 89,650 — —

Net cash used in investing activities ..................................... (15,115) (10,833) (8,683)

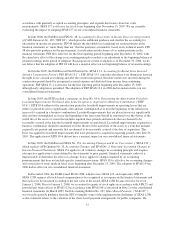

Cash flows from financing activities

Proceeds from long-term debt ...................................................... 2,119 3,944 450

Payments on long-term debt ....................................................... (2,413) (26,711) (524)

Payments on capital lease obligations ................................................ (1,840) (2,330) (1,424)

Net (payments) proceeds from revolving credit facility .................................. — (13,748) 19,457

Payments of common stock dividends ............................................... — (5,000) —

Excess tax benefits from stock-based compensation arrangements ......................... 11,260 — —

Proceeds from exercise of stock options and other stock issuances ......................... 3,544 990 78

Payments of debt financing costs ................................................... (260) (1,061) (50)

Payments received on notes from stockholders ......................................... 169 229 17

Proceeds from sale of Class A Common Stock ......................................... — 123,500 —

Payments of stock issue costs ...................................................... — (10,824) —

Redemption of Series A Preferred Stock .............................................. — (12,000) —

Net cash provided by financing activities ................................. 12,579 56,989 18,004

Effect of exchange rate changes on cash and cash equivalents ................. (487) (59) (52)

Net increase in cash and cash equivalents ................................. 7,678 61,892 418

Cash and cash equivalents

Beginning of year ............................................................... 62,977 1,085 667

End of year ..................................................................... $70,655 $ 62,977 $ 1,085

Non-cash financing and investing activities

Fair market value of shares withheld in consideration of employee tax obligations relative to

stock-based compensation ....................................................... $ 734 $ — $ —

Accretion of and cumulative preferred dividends on Series A Preferred Stock ................ — 5,307 1,994

Purchase of equipment through debt obligations ........................................ 2,700 2,103 5,156

Issuance of warrants in partial consideration for intangible asset ........................... 8,500 — —

Settlement of outstanding accounts receivable with property and equipment .................. 350 — —

Reversal of unearned compensation and additional paid in capital due to adoption of

SFAS 123R .................................................................. 715 — —

Exercise of stock-based compensation arrangements through stockholders’ notes receivable ..... — 262 —

Transfer of revolving credit facility to term debt ....................................... 25,000 —

Unpaid declared common stock dividends ............................................ — — 5,000

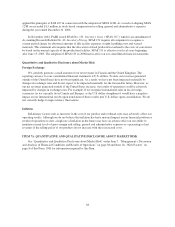

Other supplemental information

Cash paid for income taxes ........................................................ 20,522 15,204 9,775

Cashpaidforinterest............................................................. 531 2,866 1,281

See accompanying notes.

45