Under Armour 2006 Annual Report Download - page 44

Download and view the complete annual report

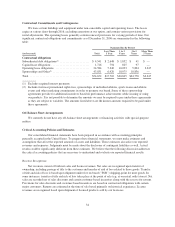

Please find page 44 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and

liabilities are established for temporary differences between the financial reporting basis and the tax basis of our

assets and liabilities at tax rates expected to be in effect when such assets or liabilities are realized or settled.

Deferred income tax assets are reduced by a valuation allowance if, in the judgment of our management, it is

more likely than not that such assets will not be realized.

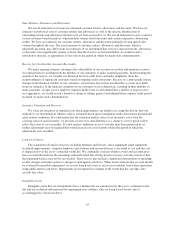

Stock-Based Compensation

Effective January 1, 2006, we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123R,

Share-Based Payment (revised 2004) (“SFAS 123R”), which revises SFAS No. 123, Accounting for Stock-Based

Compensation (“SFAS 123”) and supersedes Accounting Principles Board (“APB”) Opinion No. 25, Accounting

for Stock Issued to Employees (“APB 25”). SFAS 123R requires that all stock-based compensation be recognized

as an expense in the consolidated financial statements and that such expense be measured at the fair value of the

award. SFAS 123R also requires that excess tax benefits related to stock option exercises be reflected as

financing cash inflows instead of operating cash inflows within the statement of cash flows.

We adopted SFAS 123R using the modified prospective method of application, which requires the

recognition of compensation expense on a prospective basis; therefore, prior period consolidated financial

statements have not been restated. Compensation expense recognized includes the expense of stock rights granted

on and subsequent to January 1, 2006 and the expense for the remaining vesting term of stock rights issued

subsequent to our initial filing of the S-1 Registration Statement with the SEC on August 26, 2005. Stock rights

granted prior to our initial filing of the S-1 Registration Statement are specifically excluded from SFAS 123R

and will continue to be accounted for in accordance with APB 25 and Financial Interpretation (“FIN”) No. 28,

Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans, until fully amortized

through 2010. With the adoption of SFAS 123R, no material cumulative adjustments were recorded. As of

December 31, 2006, we had $7.3 million of unrecognized compensation expense expected to be recognized over

a weighted average period of 4.0 years.

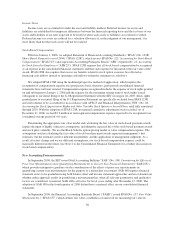

Determining the appropriate fair value model and calculating the fair value of stock-based payment awards

require the input of highly subjective assumptions, including the expected life of the stock-based payment awards

and stock price volatility. We use the Black-Scholes option-pricing model to value compensation expense. The

assumptions used in calculating the fair value of stock-based payment awards represent management’s best

estimates, but the estimates involve inherent uncertainties and the application of management judgment. As a

result, if factors change and we use different assumptions, our stock-based compensation expense could be

materially different in the future (see Note 2 to the Consolidated Financial Statements for a further discussion on

stock-based compensation).

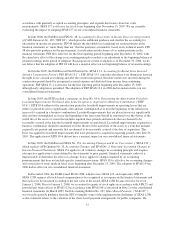

New Accounting Pronouncements

In September 2006, the SEC issued Staff Accounting Bulletin (“SAB”) No. 108, Considering the Effects of

Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements (“SAB 108”),

which provides interpretive guidance on the consideration of the effects of prior year misstatements in

quantifying current year misstatements for the purpose of a materiality assessment. SAB 108 requires financial

statement errors to be quantified using both balance sheet and income statement approaches and an evaluation on

whether either approach results in quantifying a misstatement that, when all relevant quantitative and qualitative

factors are considered, is material. SAB 108 is effective for fiscal years ending after November 15, 2006. The

adoption of SAB 108 in the fourth quarter of 2006 did not have a material effect on our consolidated financial

statements.

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 157, Fair Value

Measurements, (“SFAS 157”) which defines fair value, establishes a framework for measuring fair value in

36