Under Armour 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

granted is calculated using an expected life equal to the time from grant to the midpoint between the vesting date

and the contractual term, while considering the vesting tranches. The risk-free interest rate is based on the yield

for the U.S. Treasury bill with a maturity equal to the expected option life. Expected volatility is based on an

average for a peer group of companies similar in terms of type of business, industry, stage of life cycle and size.

Compensation expense is recognized on a straight-line basis over the total vesting period, which is the implied

requisite service period and net of forfeitures which are estimated at the date of grant based on historical rates.

The Company recognized $1,536 in stock-based compensation expense in selling, general and administrative

expenses for the year ended December 31, 2006 in accordance with SFAS 123R.

Total stock-based compensation expense for the years ended December 31, 2006 and 2005 was $1,982 and

$1,177, respectively. No stock-based compensation expense was recorded for the year ended December 31, 2004.

As of December 31, 2006, the Company had $7,273 of unrecognized compensation expense expected to be

recognized over a weighted average period of 4.0 years.

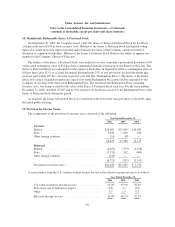

Had the Company elected to account for all stock rights granted to employees and directors at fair value in

accordance with SFAS 123 as amended by SFAS No. 148, Accounting for Stock-Based Compensation Transition

and Disclosure (“SFAS 148”), net income and earnings per share for the years ended December 31, 2006, 2005

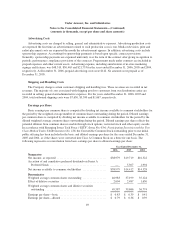

and 2004 would have been reported as set forth in the following table:

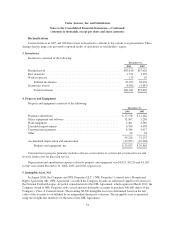

Year Ended December 31,

2006 2005 2004

Net income, as reported ................................... $38,979 $19,719 $16,322

Accretion of and cumulative preferred dividends on Series A

Preferred Stock ........................................ — 5,307 1,994

Net income available to common stockholders ................. 38,979 14,412 14,328

Add: stock-based compensation expense included in reported net

income, net of taxes .................................... 1,298 512 —

Deduct: stock-based compensation expense determined under fair

value based methods for all awards, net of taxes .............. (1,452) (266) (82)

Pro forma net income ..................................... $38,825 $14,658 $14,246

Earnings per share including SFAS 123 compensation expense

Basic, pro forma ..................................... $ 0.83 $ 0.39 $ 0.41

Diluted, pro forma ................................... $ 0.78 $ 0.37 $ 0.39

Basic, as reported .................................... $ 0.83 $ 0.39 $ 0.41

Diluted, as reported .................................. $ 0.79 $ 0.36 $ 0.39

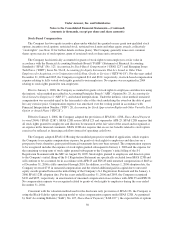

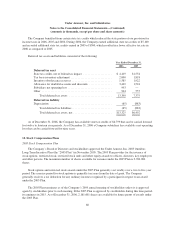

The weighted average fair value of an option granted for the years ended December 31, 2006, 2005, and

2004 was $17.14, $1.57 and $0.32, respectively. The fair value of each option granted is estimated on the date of

grant using the Black-Scholes option-pricing model with the following weighted average assumptions:

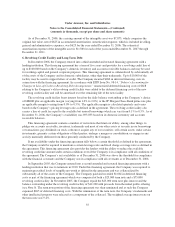

Year Ended December 31,

2006 2005 2004

Risk-free interest rate ...................... 4.6% - 5.0% 3.9% - 4.4% 3.3% - 3.5%

Average expected life in years ............... 5.5-6.5 5 5

Expected volatility ........................ 44.6% - 46.1% 0% -48.1% 0%

Expected dividend yield .................... 0% 0% 0%

51