Under Armour 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under Armour, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements—(Continued)

(amounts in thousands, except per share and share amounts)

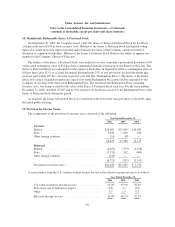

Prior to amending and restating the revolving credit facility in September 2005, the Company was party to a

revolving credit facility that was to expire April 2007. From January 2004 through September 2005, this

agreement was periodically amended to increase the available borrowings based on eligible inventory and

accounts receivable not to exceed $60,000. Interest rates and covenants under the superseded revolving credit

facility were similar to the interest rates and covenants described above.

The weighted average interest rate on the revolving credit facilities for the years ended December 31, 2005 and

2004 was 5.5% and 4.0%, respectively. During the year ended December 31, 2006, no balance was outstanding.

In March 2005, the Company entered into a loan and security agreement to finance the acquisition of up to

$17,000 of qualifying capital investments. This agreement is collateralized by a first lien on these assets and is

otherwise subordinate to the revolving credit facility. Through December 31, 2006, the Company has financed

$7,915 of furniture and fixtures under this agreement. The weighted average interest rate on borrowings was

6.5% for the year ended December 31, 2006. At December 31, 2006, the outstanding principal balance was

$4,541. Principal payments due for the years ended December 31, 2007, 2008, 2009, 2010 and 2011 are $2,648,

$1,515, $337, $41, and $0, respectively.

In December 2003, the Company entered into a master loan and security agreement that was subordinate to

the revolving credit facilities. Under this agreement the Company borrowed $1,250 for the purchase of qualifying

furniture and fixtures. The interest rate was 6.97% annually, and principal and interest payments were due

monthly through February 2006. The outstanding principal balance was repaid during February 2006.

Interest expense, included in other income (expense), net on the consolidated statements of income for all

debt was $597, $3,188 and $1,290 for the years ended December 31, 2006, 2005 and 2004, respectively. During

2005, in connection with the repayment of debt, $265 in deferred financing costs was written off and included in

interest expense. For the years ended December 31, 2006, 2005 and 2004, the Company amortized and also

included in interest expense $178, $57 and $48, respectively, of deferred financing costs.

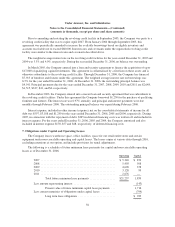

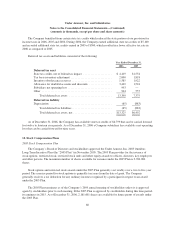

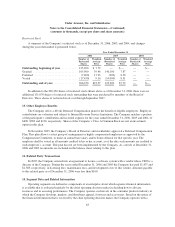

7. Obligations under Capital and Operating Leases

The Company leases warehouse space, office facilities, space for our retail outlet stores and certain

equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2016,

excluding extensions at our option, and include provisions for rental adjustments.

The following is a schedule of future minimum lease payments for capital and non-cancelable operating

leases as of December 31, 2006:

Operating Capital

2007 .................................................... $ 5,340 $ 874

2008 .................................................... 5,403 508

2009 .................................................... 4,690 378

2010 .................................................... 3,128 99

2011 .................................................... 2,676 —

Total future minimum lease payments .................. $21,237 1,859

Less amount representing interest ............................. (143)

Present value of future minimum capital lease payments . . . 1,716

Less current maturities of obligations under capital leases .......... (794)

Long term lease obligations .......................... $ 922

56