TomTom 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

Notes to the Financial Statements of TomTom NV

Continued

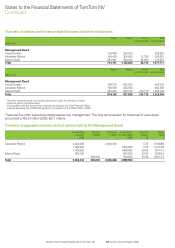

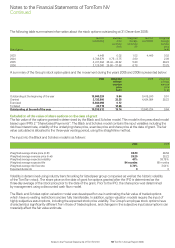

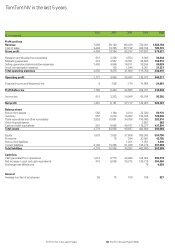

The movement of the deferred tax liabilities is as follows:

Stock Intangible Total

compensation assets

expense

(in thousands)

Balance as at

31 December 2004 1,301 1,301

Charged to income -545 -545

Balance as at

31 December 2005 756 756

Charged to income -469 -15,044 -15,513

Acquisitions 15,719 15,719

Balance as at

31 December 2006 287 675 962

A deferred tax liability is recognised for the stock

compensation expense related to the share option

plan 2003.

Increased insight into the commercial tax implications of

acquisitions made in 2005 and 2006 resulted in a gross-up

of intangible assets and the recognition of a deferred tax

liability in June 2006. This non-cash event had no impact on

net profit. A large part of this gross-up (15.0 million) was

released during 2006 as a result of amortisation of the

intellectual property and the transfer of intellectual property

between Group companies which resulted in the

recognition of a current tax liability.

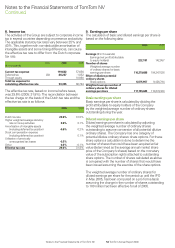

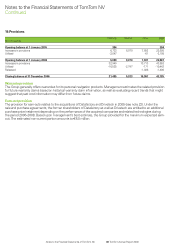

21.Off balance sheet commitments

The Group has long-term financial commitments, which

are not shown in the Group’s balance sheet as of

31 December 2006.

These are operating leases for buildings, cars and

office equipment, which consist of:

2006 2005

(in thousands)

Commitments less than 1 year 7,744 1,698

Commitments between 1–5 years 12,550 4,753

Commitments longer than 5 years 43

20,337 6,451

No discount factor is used in determining the operating

lease commitments.

As at 31 December 2006, the Group had open purchase

commitments with our contract manufacturers for certain

products and components. Based on our forecasts of the

number of units we will require, our contract manufacturers

order the requisite component parts from their suppliers.

Our manufacturers have commitments on these

components. In certain circumstances TomTom has a

contractual obligation to purchase these components

from our manufacturers.

Please refer to note 19 for disclosures on tax and legal

contingencies.

22.Business combinations

2006

Acquisition of Applied Generics Ltd.

On 11 January 2006, the Group acquired 100% of

the share capital of Applied Generics for a price of

16.5 million. Applied Generics has developed technology

that makes it possible to generate real-time road traffic

information based on the analysis of mobile network

usage and cell-switching. The technology has the

potential to deliver high-quality traffic information

at a fraction of the investment normally required to

generate traffic information.

TomTom classifies the acquisition of Applied Generics

as an acquisition of a group of identifiable assets and

liabilities which do not meet the definition of a business

under IFRS 3 “Business Combinations”.

2005

Datafactory AG

During August 2005, the Group acquired 100% of

the share capital of Datafactory AG for a price of 14.3

million. Datafactory AG offers an online system for fleet

management. The acquired company contributed

revenues of 2.2 million and a net profit of 0.4 million

to the Group for the period from 25 August 2005 to 31

December 2005. This transaction has been accounted for

using the purchase method of accounting.

Drivetech Inc.

During December 2005, the Group acquired 100%

of the share capital of Drivetech for a price of 2.7 million.

Drivetech is a company that develops navigation software

for the Taiwanese market. The Group consolidated

Drivetech from December 2005 onwards. The transaction

has been accounted for by the purchase method

of accounting.

23.Related party transactions

All related party transactions within the Group are

eliminated.