TomTom 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

Stock compensation expense

The Group issues share options, which qualify as equity-

settled share-based payments, to eligible employees

including members of management. Equity-settled share-

based payments are measured at fair value at the date of

grant. The fair value determined at the grant date of the

equity-settled share-based payments is expensed on a

straight-line basis over the vesting period, based on the

Group’s estimate of shares that will eventually vest. Fair

value is measured by use of the Black and Scholes model.

The expected life of the share options used in the model

has been adjusted, based on management’s best

estimate, for the effects of non-transferability, exercise

restrictions, and behavioural considerations. At each

balance sheet date, the entity revises its estimates

of the number of options that are expected to become

exercisable. It recognises the impact of the revision

of original estimates, if any, in the income statement,

and makes a corresponding adjustment to equity (stock

compensation reserve) over the remaining vesting

period. The proceeds received, net of any directly

attributable transaction costs, are credited to share

capital (nominal value) and share premium when the

options are exercised.

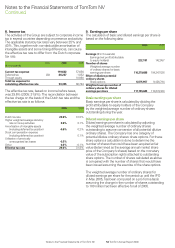

Taxation

Income tax expense represents the sum of the tax

currently payable and deferred tax.

Deferred taxes are calculated using the liability method.

Deferred income taxes reflect the net tax effects of

temporary differences between the carrying amounts

of assets and liabilities for financial reporting purposes

and the amounts used for income tax purposes. Deferred

tax assets and liabilities are measured using the tax rates

expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered

or settled. The measurement of deferred tax liabilities

and deferred tax assets reflects the tax consequences

that would follow from the manner in which the Group

expects, at the balance sheet date, to recover or settle

the carrying amount of its assets and liabilities.

Deferred tax assets are recognised when it is probable that

sufficient taxable profits will be available against which the

deferred tax assets can be utilised. The carrying amount of

deferred tax assets is reviewed at each balance sheet date

and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part

of the asset to be recovered.

Current and deferred taxes are recognised as an expense

or income in the profit and loss account, except when they

relate to items credited or charged directly to equity, in

which case the tax is also recognised directly in equity, or

where they arise from the initial accounting for a business

combination.

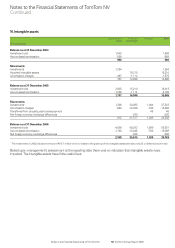

Intangible assets

Development costs

Internally generated software development costs arising

from the creation and update of the Company’s core

software technology are recognised as an asset only

if all of the following relevant criteria are met:

— an asset is created that can be identified;

— it is probable that the asset created will generate

future economic benefits; and

— the development cost of the asset can be

measured reliably.

Internal software development costs related to creating

and upgrading the Group’s core software platform are

capitalised and amortised on a straight-line basis over the

useful economic life of the software, which is estimated

to be four years.

Internal software costs not relating to the Group’s

core software platform are expensed as research and

development costs as incurred on the basis that on

average these costs have a useful economic life of less

than one year.

Engineering costs relating to the detailed manufacturing

design of new products are recorded in the income

statement as research and development expenses

as incurred.

The Group is required to use estimates, assumptions and

judgements to determine the expected useful economic

lives and future economic benefits of these costs. Such

estimates are made on a regular basis or as appropriate

throughout the year as they can be significantly affected

by changes in technology and other factors.

Acquired technology

Intangible assets arising from acquisitions are amortised

using the straight-line method over their estimated

economic lives, which is estimated to be four years.

Economic lives are re-evaluated every year.

Computer software

Computer software includes purchased software to

facilitate our global information processing. The software is

amortised on a straight-line basis over its estimated useful

life of two to five years.

Notes to the Financial Statements of TomTom NV

Continued