TomTom 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45 TomTom Annual Report 2006

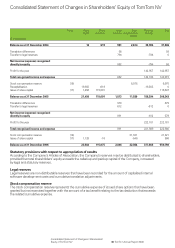

Consolidated Statement of Changes in Shareholders’

Equity of TomTom NV

Consolidated Statement of Changes in Shareholders’ Equity of TomTom NV

Notes Share Share Legal Stock Retained Total

capital premium reserves compensation earnings

reserve

(in thousands)

Balance as at 31 December 2004 18 619 961 2,614 33,594 37,806

Translation differences 58 58

Transfer to legal reserves 794 -794 0

Net income (expense) recognised

directly in equity 852 -794 58

Profit for the year 142,957 142,957

Total recognised income and expense 852 142,163 143,015

Stock compensation reserve (18) 8,975 8,975

Recapitalisation 19,982 -619 -19,363 0

Issue of share capital (17) 1,456 115,091 116,547

Balance as at 31 December 2005 21,456 115,091 1,813 11,589 156,394 306,343

Translation differences 379 379

Transfer to legal reserves 612 -612 0

Net income (expense) recognised

directly in equity 991 -612 379

Profit for the year 222,181 222,181

Total recognised income and expense 991 221,569 222,560

Stock compensation reserve (18) 21,321 21,321

Issue of share capital (17) 1,128 -16 -546 566

Balance as at 31 December 2006 22,584 115,075 2,804 32,364 377,963 550,790

Statutory provisions with respect to appropriation of results

According to the Company’s Articles of Association, the Company’s reserves may be distributed to shareholders,

provided that total shareholders’ equity exceeds the called-up and paid-up capital of the Company, increased

by legal and statutory reserves.

Legal reserves

Legal reserves are non-distributable reserves that have been recorded for the amount of capitalised internal

software development costs and cumulative translation adjustments.

Stock compensation reserve

The stock compensation reserve represents the cumulative expense of issued share options that have been

granted but not exercised together with the amount of a tax benefit relating to the tax deduction that exceeds

the related cumulative expense.