TomTom 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

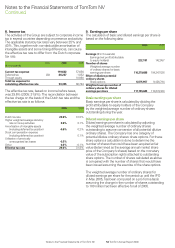

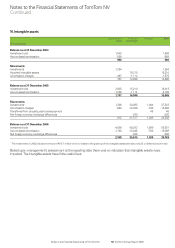

8. Income tax

The activities of the Group are subject to corporate income

tax in several countries depending on presence and activity.

The applicable statutory tax rates vary between 25% and

40%. This, together with non-deductible amortisation of

intangible assets and some timing differences, can cause

the effective tax rate to differ from the Dutch corporate

tax rate.

Note 2006 2005

(in thousands)

Current tax expense 119,622 57,656

Deferred tax (20) -26,267 -1,852

Through equity 10,980

Total tax expense for

calculating effective tax rate 93,355 66,784

The effective tax rate, based on income before taxes,

was 29.6% (2005: 31.8%). The reconciliation between

the tax charge on the basis of the Dutch tax rate and the

effective tax rate is as follows:

2006 2005

Dutch tax rate 29.6% 31.5%

Higher weighted average statutory

rate on Group activities 0.6% 0.1%

Amortisation of intangible assets

(including deferred tax position) -0.6% 0.2%

Stock compensation expense

(including deferred tax position) 0.1%

Utilisation of previously

unrecognised tax losses -0.2%

Other 0.2% -0.1%

Effective tax rate 29.6% 31.8%

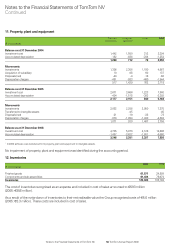

9. Earnings per share

The calculation of basic and diluted earnings per share is

based on the following data:

2006 2005

Earnings (in thousands)

Earnings (net profit attributable

to equity holders) 222,181 142,957

Number of shares

Weighted average number

of ordinary shares for basic

earnings per share 110,279,686 104,247,526

Effect of dilutive potential

ordinary shares

Share options 6,875,957 9,426,794

Weighted average number of

ordinary shares for diluted

earnings per share 117,155,643 113,674,320

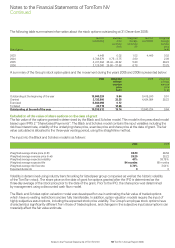

Basic earnings per share

Basic earnings per share is calculated by dividing the

profit attributable to equity holders of the Company

by the weighted average number of ordinary shares

outstanding during the year.

Diluted earnings per share

Diluted earnings per share is calculated by adjusting

the weighted average number of ordinary shares

outstanding to assume conversion of all potential dilutive

ordinary shares. The Company has one category of

potential dilutive ordinary shares: share options. For these

share options a calculation is done to determine the

number of shares that could have been acquired at fair

value (determined as the average annual market share

price of the Company’s shares) based on the monetary

value of the subscription rights attached to outstanding

share options. The number of shares calculated as above

is compared with the number of shares that would have

been issued assuming the exercise of the share options.

The weighted average number of ordinary shares for

diluted earnings per share for the period up until the IPO

in May 2005, has been computed on a pro forma basis

assuming the change in the number of shares outstanding

to 100 million had been effective for all of 2005.

Notes to the Financial Statements of TomTom NV

Continued