TomTom 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 TomTom Annual Report 2006Notes to the Financial Statements of TomTom NV

Notes to the Financial Statements of TomTom NV

Continued

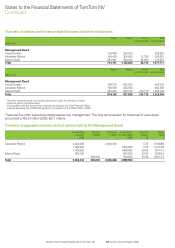

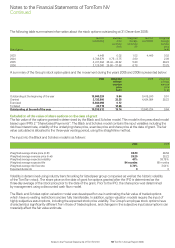

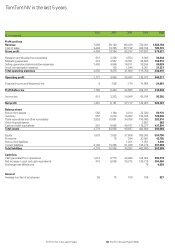

The following table summarises information about the stock options outstanding at 31 December 2006:

Number Exercise Weighted Number Weighted

outstanding price average exercisable average

per share remaining exercise

(in ) life price

Year of grant (in )

2003 4,449 0.02 1.02 4,449 0.02

2004 3,746,579 0.75 – 3.75 2.60 2.09

2005 4,417,484 26.44 – 28.82 5.80 28.22

2006 2,125,000 25.50 – 37.68 6.78 33.25

A summary of the Group’s stock option plans and the movement during the years 2005 and 2006 is presented below:

2006 Weighted 2005 Weighted

average average

exercise exercise

price price

(in )(in )

Outstanding at the beginning of the year 13,840,224 9.64 9,415,240 0.91

Granted 2,132,500 33.25 4,424,984 28.22

Exercised -5,640,093 0.12

Forfeited -39,119 12.86

Outstanding at the end of the year 10,293,512 19.74 13,840,224 9.64

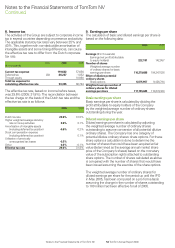

Calculation of the value of share options on the date of grant

The fair value of the options granted is determined by the Black and Scholes model. This model is the prescribed model

based upon IFRS 2 “Share-based Payments”. The Black and Scholes model contains the input variables including the

risk-free interest rate, volatility of the underlying share price, exercise price and share price at the date of grant. The fair

value calculated is allocated to the three-year vesting period, using the straight-line method.

The input into the Black and Scholes model is as follows:

2006 2005

Weighted average share price (in )33.23 28.58

Weighted average exercise price (in )33.25 28.22

Weighted average expected volatility 40% 38.75%

Weighted average expected life 84 months 68 months

Weighted average risk-free rate 3.74% 3.04%

Expected dividends 00

Volatility is determined using industry benchmarking for listed peer group companies as well as the historic volatility

of the TomTom stock. The share price on the date of grant for options granted after the IPO is determined as the

three-day average of the stock price prior to the date of the grant. Prior to the IPO, the share price was determined

by management using a discounted cash flow model.

The Black and Scholes option valuation model was developed for use in estimating the fair value of traded options

which have no vesting restrictions and are fully transferable. In addition, option valuation models require the input of

highly subjective assumptions, including the expected stock price volatility. The Group’s employee stock options have

characteristics significantly different from those of traded options, and changes in the subjective input assumptions can

materially affect the fair value estimate.