Snapple 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

At DPS, fl avor innovation is at the center of everything

we do. Our research and development team works

closely with all our business functions, ensuring strong

collaboration, quick decision making and unwavering

execution on one clear goal:

CREATE GREAT-TASTING

PRODUCTS THAT

CONSUME RS LOVE.

Dr Pepper TEN and its proprietary blend of sweeteners

is bringing lapsed consumers back to the category.

Delivering the same 23 authentic fl avors as our fl agship

brand but with only 10 calories per 8-oz. serving,

Dr Pepper TEN, with its bold taste and even bolder “It’s

Not for Women” marketing campaign, inspired consumers

to give it a try when it launched in October. During the

fi rst three months of national distribution, trial rates for

Dr Pepper TEN were nearly 9 percent, signifi cantly

above other new innovation launches. The great taste of

Dr Pepper TEN, which is targeted at men who don’t like

the image of diet beverages, has resulted in consumers

– male and female – asking for more TEN options. We’re

delivering, and quickly. In February 2012, just four months

after the national launch of Dr Pepper TEN, we began

market testing additional TEN options, including 7UP,

Canada Dry, Sunkist soda, A&W and RC Cola.

Sun Drop is another example of how we’re leading with

fl avor and reaching a new generation of citrus fans. A

regional brand we introduced nationwide in early 2011,

Sun Drop has already captured a 4 percent share of the

highly competitive citrus market, driving 43 percent of the

growth in that category. A multi-year agreement with MTV

and the “That’s How You Drop It” campaign featuring the

Sun Drop Girl contributed to Sun Drop reaching more

than 80 percent ACV in grocery in its second month of

national distribution. In 2012, we introduced the Sun Drop

Guy to refuel the campaign and recharge loyal Sun Drop

consumers who crave their citrus.

Snapple Lightly Sweetened Teas

Less sweet yet still refreshing, Snapple Lightly Sweetened

Teas will bring new consumers to the ready-to-drink tea

category, meeting the needs of those who prefer all-natural,

lighter-tasting options. DPS continues to outperform in

the premium tea category, with the new Snapple 64-oz.

multiserve package providing incremental growth and

additional take-home options for consumers in 2011.

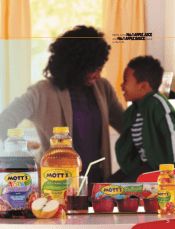

Mott’s Medleys Sauce

As the No. 1 apple sauce brand, Mott’s is leading with

fl avor and nutrition. Mott’s Medleys Sauce, introduced

in 2011, contains one fruit and vegetable serving per

container and is the fi rst nationally distributed fruit and

veggie snack in the sauce category. Mott’s for Tots juices

with added nutrients provide additional healthy choices

and contain 40 percent less sugar.

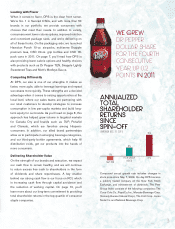

HOUSEHOLDS

Snapple grew household

penetration by 17%

in 2011, triple the rate

of category growth.

CONSUMERS

Snapple outpaced

the tea category in

generating repeat

purchases in 2011.

TEA

CATEGORY

SNAPPLE

2011 SNAPPLE

HOUSEHOLD

PENETRATION

GROWTH

5%

17 %

2011 SNAPPLE

REPEAT PURCHASE

GROWTH

TEA

CATEGORY

SNAPPLE

1%

5%