Snapple 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

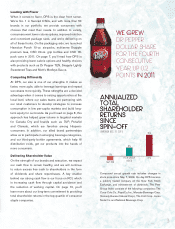

In 2011, despite challenging macroeconomic conditions,

including some of the highest commodity infl ation in years

and ongoing economic pressures, our brands continued

to perform well. We grew net sales 5 percent, and our

cash fl ow remained strong and consistent, enabling us

to return approximately $773 million to shareholders last

year, with $522 million in share repurchases and $251

million in dividends.

During the year, we increased our all-commodity volume

(ACV) distribution, getting more of our products into a

higher percentage of retailers and gaining additional

shelf space. We increased ACV on our core brands

and packages in grocery by 8 percentage points for

carbonated soft drinks (CSDs) and 2 percentage points

for Snapple and Mott’s.

We also continued to grow per-capita consumption

in targeted markets for Snapple, up 1.2 servings per

person, and Canada Dry, up 0.3 servings. In addition,

11 of our 14 leading brands continue to hold the No. 1

position in their fl avor category.

Our priorities remain clear and unchanged: building our

brands, growing per-capita consumption, and creating

a strong business foundation underpinned by rapid

continuous improvement (RCI).

*2011 diluted earnings per share (EPS) excludes a legal reserve,

which totaled 5 cents per share. 2010 diluted EPS excludes

a loss on early extinguishment of debt and certain tax-related

items, which totaled 23 cents per share. See page 13 for a

detailed reconciliation of the excluded items and the rationale for

the exclusion.

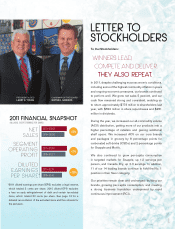

PRESIDENT & CEO

LARRY D. YOUNG

CHAIRMAN OF THE BOARD

WAYNE R. SANDERS

1

To Our Stockholders:

WINNERS LEAD,

COMPETE AND DELIVER.

THEY ALSO REPEAT.

LETTER TO

STOCKHOLDERS

2011 FINANCIAL SNAPSHOT

(MILLIONS, EXCEPT EARNINGS PER SHARE)

NET

SALES

SEGMENT

O

PERATING

PROFIT

DILUTED

EARNINGS

PER SHARE*

2011 $5,903

2010 $5,636

2011 $1,341

2010 $1,321

2011 $2.79

2010 $2.40

+5%

+2%

+16%