Snapple 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our ability to execute against these priorities is

exemplifi ed by the wins we achieved in 2011.

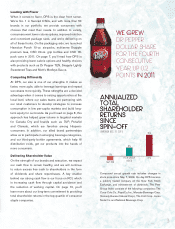

• We grew Dr Pepper dollar share for the fourth

consecutive year, up 0.2 points in 2011.

• Snapple, the leader in premium teas, continued its

momentum, with volume up more than 7 percent on

top of double-digit gains in 2010.

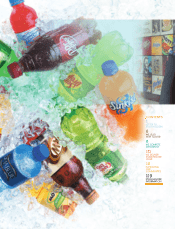

• We took Sun Drop nationwide in early 2011,

delivering 9 million incremental cases and achieving

93 percent ACV in grocery. Sun Drop now holds the

No. 2 branded spot in the citrus category.

• We launched Dr Pepper TEN, a low-calorie version

of our fl agship brand, after we achieved a 6 percent

volume lift for the entire Dr Pepper product line during

three months in test markets. Based on the positive

consumer response to Dr Pepper TEN, we’re testing

additional TEN offerings in 2012 for 7UP, Canada Dry,

Sunkist soda, A&W and RC Cola.

• Canada increased market share for its priority brands,

with dollar share up 1.1 points.

• We made gains on brands repatriated from

The Coca-Cola Co. and PepsiCo, Inc., exceeding

our internal volume targets.

• Building on our strategy to win in single serve and

immediate consumption, we added 43,000 fountain

valves and 25,000 cold-drink placements, focusing on

quality placements and profi table assortment mix. In total,

our fountain foodservice volume grew 5 percent in 2011.

• Latin America Beverages grew volume 4 percent,

driven by increases for Squirt, Peñafi el and Clamato.

• More than 1,200 employees participated in 90-plus

RCI projects across the company in 2011, improving

productivity and freeing up resources to redirect

toward growing distribution and availability and

increasing per-capita consumption of our brands.

Growing our Business

In 2011, we implemented strategies to improve both price

and mix across our CSD and non-carbonated portfolios to

help defray the signifi cant increases in commodity costs.

These actions, the performance of certain repatriated brands

and the revenues associated with The Coca-Cola Co. and

PepsiCo, Inc. transactions helped offset a slight decline

in overall volume, resulting in the 5 percent increase in net

sales. Segment operating profi t was up 2 percent, refl ecting

net sales growth, partially offset by higher packaging and

ingredient costs and a one-time legal provision. Excluding

certain items, we earned $2.79 per diluted share, an increase

of 16 percent as compared with 2010.

Our opportunities to grow distribution and availability and

increase per-capita consumption in North America are well

within our reach. Many markets remain untapped, and we

believe that over the long term DPS has an 800 million case

opportunity to increase consumption for brands such as

Dr Pepper, our Core 4 (7UP, Canada Dry, Sunkist soda

and A&W), Crush, Snapple and Mott’s.

2