Snapple 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Looking Forward

Our unmatched brand portfolio, unwavering focus on

our strategic priorities and increasing engagement

in RCI will enable us to continue to execute against

a winning strategy that has remained consistent

since 2008. Strong marketing support behind our

brands will continue, with compelling advertising,

programming that addresses purchase barriers

and campaigns that create awareness and trial.

Using research on how consumers navigate stores

and category aisles, we’ll further refi ne our retail

execution strategy.

We’ll also continue to engage, align and mobilize our

people around our Call to ACTION initiative, extending

capabilities to frontline employees and leveraging

online DPS Campus training to enable even better

execution. Our people, a team 19,000 strong, are the

heart of the organization, and we value their talents

and contributions.

As we lead with our fl avor portfolio and play to our

strengths of speed and agility to outpace the competition,

we are confi dent in our ability to deliver long-term,

sustainable growth and to increase shareholder value in

2012 and beyond.

Sincerely,

Wayne R. Sanders

Chairman of the Board

Larry D. Young

President & Chief Executive Offi cer

March 2, 2012

4

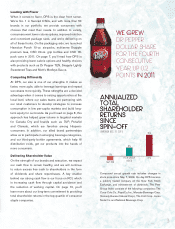

*Includes one-time licensing agreement payments

from The Coca-Cola Co. and PepsiCo, Inc.

SOURCES USES

PRIMARY SOURCES

& USES OF CASH

$3.8 Billion

$4.2 Billion

(THREE-YEAR CUMULATIVE TOTAL 2009–2011)

PEPSI/COKE

LICENSING

AGREEMENTS

OPERATIONS

SHARE REPURCHASES

DIVIDENDS

NET REPAYMENT OF

CREDIT FACILITY & NOTES

CAPITAL SPENDING

CASH

FLOW

FROM OPERATIONS

(IN MILLIONS)

FOUR–YEAR TOTAL: $4.87 BILLION

2008 2009 2010 2 011

$709

$865

$2,535*

$760