Snapple 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

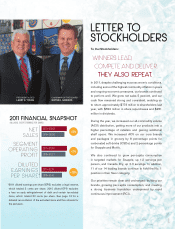

At DPS, we are focused on cash generation and

shareholder returns. We’ve been consistent in returning

excess free cash to our shareholders, and expect to

continue to do so in the years ahead. In early 2012, we

announced the fourth increase to our dividend, once again

demonstrating our commitment to grow dividends over

time. Our annual payout is now $1.36 per share, giving

us a strong dividend yield in today’s market. Moreover, in

2010 and 2011, we repurchased $1.6 billion of our stock

and expect to buy back $350 million to $375 million in

2012, subject to market conditions.

A KEY ENABLER BEHIND OUR

ONGOING HEALTHY CASH

FLOW IS OUR ABILITY TO

CONTINUOUSLY IMPROVE .

We operate in developed markets, reducing the need

for costly acquisitions as we work to get the best-tasting

CSDs, premium teas and juices into the hands of more

consumers. Our goal is to grow the business organically,

allowing us to continue to return excess free cash

to shareholders.

Key enablers behind our ongoing healthy cash fl ow are our

continuing investments in our people, brands and systems

to ensure we are positioned to grow profi tably over the long

term, as well as our ability to continuously improve in all

areas. At DPS, we call this rapid continuous improvement,

and it’s a growing capability within our company. RCI

focuses our processes on what is truly value-added to our

customers, eliminating waste and unnecessary activities

and thereby improving productivity.

While we are still in the early stages of our RCI journey,

we’ve made improvements in sales productivity, marketing

and innovation, while reducing costs and inventory, as

well as lowering certain capital requirements. In the

process, we’re freeing up critical resources – people, time

and money – that can be redirected toward building our

brands, growing our business and contributing strong

total shareholder returns.

10

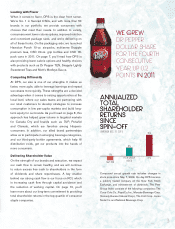

*One-time payments of more than

$1.6 billion from The Coca-Cola Co.

and PepsiCo, Inc. in 2010 helped

fund additional share repurchases.

DIVIDENDS

(ANNUALIZED AMOUNTS)

SHARE REPURCHASES

(IN MILLIONS)

STRONG CASH F

LOW

IS BUILDING

SHAREHOLDER VALUE

‘09–’10 ‘10–’11 ‘11–’12 ’10

$0.60-$1.00

$1.00-$1.28

$1.28-$1.36

$1,113*

’11

$522