Snapple 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Since 2008, we’ve boosted our annual marketing

spend by $100 million to keep our brands top of

mind with consumers.

9

Sponsorship of The Latin GRAMMY® Awards in 2011

and related consumer events resulted in a 28 percent

volume increase for brands such as 7UP, Sunkist

soda and Squirt in participating retail accounts during

the promotion. In the Los Angeles market, these

efforts helped increase per-capita consumption

of fl avors popular with Hispanic consumers by six

servings per person.

Allied Brands

Our distribution agreements with brands such as

Neuro functional beverages and Vita Coco, the

No. 1 brand of coconut water, allow us to participate

in emerging categories without signifi cant capital

investment, while providing scale and effi ciencies in

our direct store distribution. In 2011, Neuro added

approximately 400,000 incremental cases to our

volume, and Vita Coco added approximately

300,000 cases.

Priority Brand Execution

Our priority brand agreements ensure that Dr Pepper

and Diet Dr Pepper are included in all core packages

and featured in all major merchandising events and

display activities by our bottlers. Our consumers are

able to enjoy our brands in multiple package offerings

and at different price points, enabling us to leverage

package innovation by our bottlers. Display and

merchandising tie-in activity helped drive awareness

and incremental purchases of our brands in 2011,

with display tie-in rates for regular Dr Pepper up

2 percentage points.

MARKETING

MARKETING

INVESTMENT

INVESTMENT

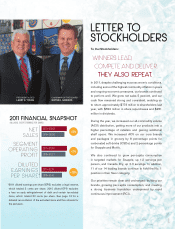

B

EHI

EHIND OUR BRANDS

2008 2009 2010

$356

$409

$445

2011

$460

(IN MILLIONS)