Snapple 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

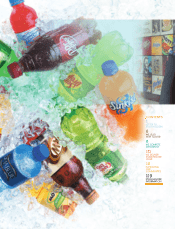

Flavors now represent more than 51 percent of all CSD

retail sales, up nearly 5 points in the last six years.

With a 40 percent dollar share of fl avored CSDs, we

are the undisputed leader in this segment. Even so,

DPS has opportunities across the U.S. to introduce

new consumers to our fl avor portfolio and increase

drinking occasions for our core brands. To support

long-term growth, we’re investing heavily behind our

brands, and in 2012 we’ll continue to shift a portion of

our marketing investments from national to local levels,

enabling us to grow consumption of our brands in low

per-capita markets.

Local marketing investments behind Canada Dry,

including localized media and display activity, accelerated

volume growth in 2011 in 14 underdeveloped markets,

including San Francisco, Calif., up 9 percent;

Columbus, Ohio, up 12 percent; and Las Vegas,

Nev., up 22 percent. Sales teams in these markets

partnered closely with retailers to drive distribution of

our brands. In addition, local radio and billboard media

provided the ability to personalize ads with store logos

and promotions and gave retailers the opportunity

to gain traction in their local areas while growing

trademark loyalty behind our key package sizes and

fl avors. In targeted markets, these efforts resulted in

an almost 11 percent volume increase for Canada Dry.

This winning formula is being replicated in markets

across the country. For example, we’re connecting with

Hispanic consumers’ passion for music, sports and

fl avor at a grassroots level across southern California.

CANADA DRY POSTED

DOUBLE-DIGIT VOLUME

GROWTH FOR THE

SECOND YEAR IN A ROW.