Snapple 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Leading with Flavor

When it comes to fl avor, DPS is the clear front runner.

We’re No. 1 in fl avored CSDs, and with more than 50

brands in our portfolio, we provide consumers with

choices that meet their needs. In addition to variety,

consumers want lower calorie options, improved nutrition

and convenient package sizes, and we’re delivering on

all of these fronts. On the packaging side, we launched

Hawaiian Punch 10-oz. six-packs, multiserve Snapple

premium teas, CSD 20-oz. grip bottles and CSD 18-

pack cans in 2011. On page 7, you’ll read how DPS is

also providing lower calorie options and healthy choices

with products such as Dr Pepper TEN, Snapple Lightly

Sweetened Teas and Mott’s Medleys Sauce.

Competing Differently

At DPS, our size is one of our strengths. It makes us

faster, more agile, able to leverage learnings and repeat

successes more quickly. These strengths are a decided

advantage when it comes to seizing opportunities at the

local level, where our sales teams are partnering with

our retail customers to develop strategies to increase

consumption in low per-capita markets and build long-

term equity for our brands. As you’ll read on page 8, this

approach has helped grow volume in targeted markets

for Canada Dry and brands such as 7UP, Peñafi el

and Clamato, which are favorites among Hispanic

consumers. In addition, our allied brand partnerships

allow us to participate in emerging beverage categories,

and our third-party bottler agreements, which help fi ll

distribution voids, get our products into the hands of

more consumers.

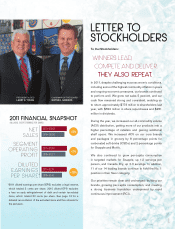

Delivering Shareholder Value

On the strength of our brands and execution, we expect

our cash fl ow to remain healthy, and we will continue

to return excess free cash to shareholders in the form

of dividends and share repurchases. A key enabler

behind our strong cash fl ow is our focus on RCI, which

is increasing cash fl ow through capital avoidance and

the reduction of working capital. On page 10, you’ll

learn more about our long-term commitment to providing

total shareholder returns in the top quartile of consumer

staple companies.

Compound annual growth rate includes changes in

stock price since May 7, 2008, the day DPS became

a publicly traded company on the New York Stock

Exchange, and reinvestment of dividends. The Peer

Group Index consists of the following companies: The

Coca-Cola Co., PepsiCo, Inc., Monster Beverage Corp.

(formerly Hansen Natural Corp.), The Cott Corp., Jones

Soda Co. and National Beverage Corp.

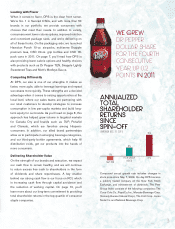

WE GREW

DR PEPPER

DOLLAR SHARE

FOR THE FOURTH

CONSECUTIVE

YEAR, UP 0.2

POINTS IN 2011.

ANNUALIZED

TOTAL

SHAREHOLDER

RETURNS

SINCE

SPIN–OFF

S&P 500

PEER GROUP

INDEX

DPS

-3%

6%

(THROUGH DEC. 31, 2011) 15%