Sharp 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The maximum amount that the Company can distribute as

dividends is calculated based on the nonconsolidated financial

statements of the Company in accordance with the Law.

Year end cash dividends are approved by the sharehold-

ers after the end of each fiscal year, and semiannual interim

cash dividends are declared by the Board of Directors after

the end of each interim six-month period. Such dividends

are payable to shareholders of record at the end of each

fiscal year or interim six-month period. In accordance with

the Law, final cash dividends and the related appropriations

of retained earnings have not been reflected in the financial

statements at the end of such fiscal year. However, cash

dividends per share shown in the accompanying consoli-

dated statements of operations reflect dividends applicable

to the respective period.

On June 23, 2010, the shareholders approved the declara-

tion of year end cash dividends totaling ¥11,004 million

($119,609 thousand) to shareholders of record as of March

31, 2010, covering the year then ended.

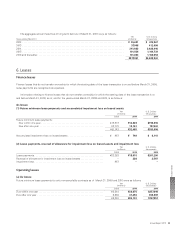

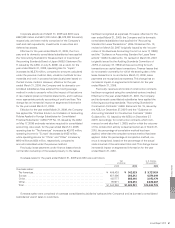

10. Contingent Liabilities

As of March 31, 2010, the Company and its consolidated subsidiaries had contingent liabilities as follows:

Yen

(millions)

U.S. Dollars

(thousands)

2010 2010

Loans guaranteed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥29,281 $318,272

¥29,281 $318,272

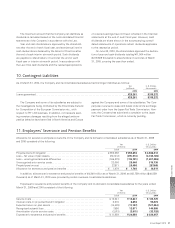

The Company and some of its subsidiaries are subject to

the investigations being conducted by the Directorate-General

for Competition of the European Commission etc., with

respect to TFT LCD business. In addition, civil lawsuits seek-

ing monetary damages resulting from the alleged anticom-

petitive behavior have been filed in North America and Europe

against the Company and some of its subsidiaries. The Com-

pany also received a cease and desist order and a surcharge

payment order from the Japan Fair Trade Commission. How-

ever, the Company has submitted a complaint to the Japan

Fair Trade Commission, which is currently pending.

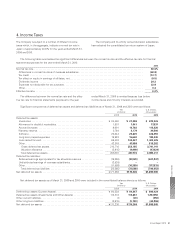

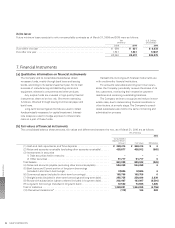

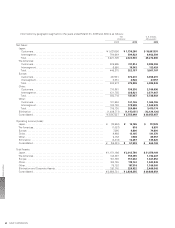

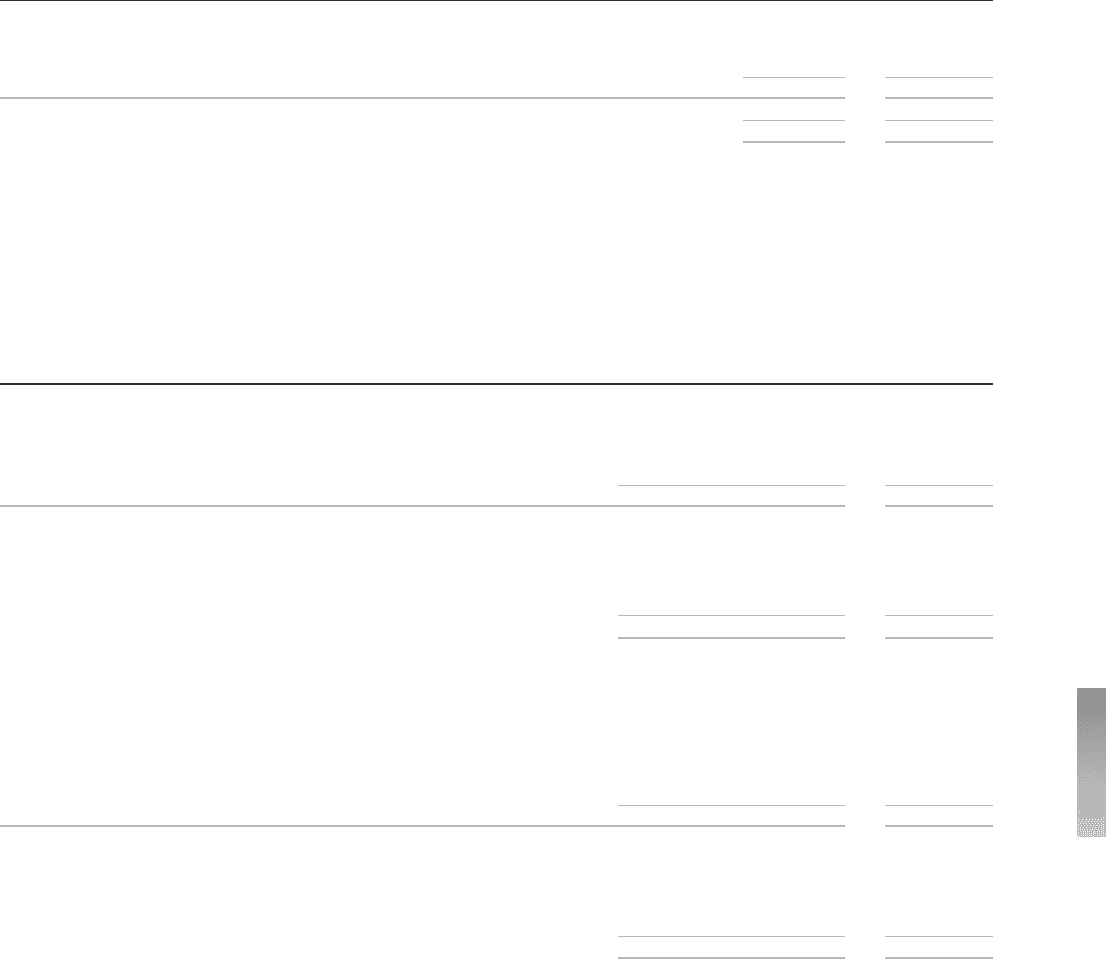

11. Employees’ Severance and Pension Benefits

Allowance for severance and pension benefits of the Company and its domestic consolidated subsidiaries as of March 31, 2009

and 2010 consisted of the following:

Yen

(millions)

U.S. Dollars

(thousands)

2009 2010 2010

Projected benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 355,538 ¥ 355,894 $ 3,868,413

Less – fair value of plan assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (247,412) (290,914) (3,162,108)

Less – unrecognized actuarial differences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (166,278) (118,781) (1,291,098)

Unrecognized prior service costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32,060 29,048 315,739

Prepaid pension cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,571 26,456 287,565

Allowance for severance and pension benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 1,479 ¥ 1,703 $ 18,511

In addition, allowances for severance and pension benefits of ¥4,240 million as of March 31, 2009 and ¥3,759 million ($40,859

thousand) as of March 31, 2010 were provided by certain overseas consolidated subsidiaries.

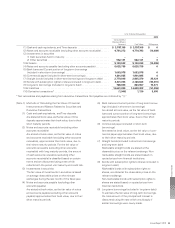

Expenses for severance and pension benefits of the Company and its domestic consolidated subsidiaries for the years ended

March 31, 2009 and 2010 consisted of the following:

Yen

(millions)

U.S. Dollars

(thousands)

2009 2010 2010

Service costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 12,841 ¥ 12,841 $ 139,576

Interest costs on projected benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,870 8,894 96,674

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,439) (11,137) (121,054)

Recognized actuarial loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,598 12,971 140,989

Amortization of prior service costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,011) (3,011) (32,728)

Expenses for severance and pension benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 11,859 ¥ 20,558 $ 223,457

Financial Section

Annual Report 2010 57