Sharp 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

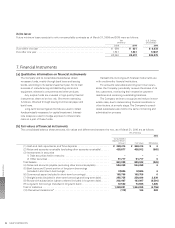

If certain hedging criteria are met, interest rate swaps are

not recognized at their fair values as an alternative method

under Japanese accounting standards. The net amounts

received or paid for such interest rate swap arrangements are

charged or credited to income as incurred.

Derivative financial instruments are used based on inter-

nal policies and procedures on risk control.

The risks of fluctuations in foreign currency exchange

rates and interest rates have been assumed to be completely

hedged over the period of hedging contracts as the major

conditions of the hedging instruments and the hedged items

are consistent. Accordingly, an evaluation of the effectiveness

of the hedging contracts is not required.

The credit risk of such derivatives is assessed as being

low because the counter-parties of these transactions have

good credit ratings with financial institutions.

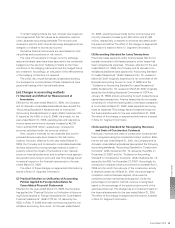

(m) Changes in accounting methods

(1) Standard and Method for Measurement of

Inventories

Effective for the year ended March 31, 2009, the Company

and its domestic consolidated subsidiaries have applied the

“Accounting Standard for Measurement of Inventories”

(Accounting Standards Board of Japan (ASBJ) Statement No.

9, issued by the ASBJ on July 5, 2006). As a result, for the

year ended March 31, 2009, operating loss and loss before

income taxes and minority interests increase by ¥5,274

million and ¥12,919 million, respectively, compared to

amounts calculated under the previous method.

Also, valuation methods for raw materials and work in

process had previously been based on the last invoice

method. However, effective for the year ended March 31,

2009, the Company and its domestic consolidated subsidiar-

ies have adopted the moving average method in order to

properly reflect the impact of fluctuations in raw material

prices on financial statements, and to achieve more appropri-

ate periodic accounting of profit and loss. This change has an

immaterial impact on the financial statements for the year

ended March 31, 2009.

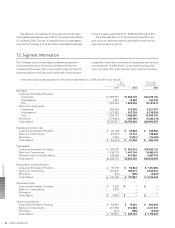

The effect of these changes on segmented information is

stated in Note 12. Segment Information.

(2) Practical Solution on Unification of Accounting

Policies Applied to Foreign Subsidiaries for

Consolidated Financial Statements

Effective for the year ended March 31, 2009, the Company

has applied the “Practical Solution on Unification of Account-

ing Policies Applied to Foreign Subsidiaries for Consolidated

Financial Statements” (ASBJ PITF No. 18, issued by the

ASBJ on May 17, 2006) and made revisions required for con-

solidated accounting. As a result, for the year ended March

31, 2009, operating loss and loss before income taxes and

minority interests increase by ¥1,804 million and ¥1,922

million, respectively, compared to amounts calculated under

the previous method. The effect of this change on segmented

information is stated in Note 12. Segment Information.

(3) Accounting Standard for Lease Transactions

Previously, lease payments under finance leases that do not

transfer ownership of the leased property to the lessee had

been recognized as expenses. However, effective for the year

ended March 31, 2009, the Company and its domestic con-

solidated subsidiaries have applied the “Accounting Standard

for Lease Transactions” (ASBJ Statement No. 13, revised on

March 30, 2007 (originally issued by the 1st committee of the

Business Accounting Council on June 17, 1993)) and the

“Guidance on Accounting Standard for Lease Transactions”

(ASBJ Guidance No. 16, revised on March 30, 2007 (originally

issued by the Auditing Standards Committee of JICPA on

January 18, 1994)) and are accounting for such transactions as

capital lease transactions. Finance leases that do not transfer

ownership for which the starting date of the lease transaction

is on and before March 31, 2008, lease payments are recog-

nized as expenses. This change has an immaterial impact on

the financial statements for the year ended March 31, 2009.

The effect of this change on segmented information is stated

in Note 12. Segment Information.

(4) Accounting Standard for Recognizing Revenues

and Costs of Construction Contracts

Previously, revenues and costs of construction contracts had

been recognized using the completed-contract method. Effec-

tive for the year ended March 31, 2010, the Company and its

domestic consolidated subsidiaries have applied the following

accounting standards; “Accounting Standard for Construction

Contracts” (ASBJ Statement No. 15, issued by the ASBJ on

December 27, 2007) and the “Guidance on Accounting

Standard for Construction Contracts” (ASBJ Guidance No. 18,

issued by the ASBJ on December 27, 2007). Accordingly, for

construction contracts which commenced on and after April 1,

2009, and for which the outcome of the construction activity

is deemed certain as of March 31, 2010, the percentage-of-

completion method has been applied, otherwise the

complete-contract method has been applied. Under the

percentage-of-completion method, revenue is recognized,

based on the percentage of the actual costs incurred of the

estimated total cost. This change has an immaterial impact on

the financial statements for the year ended March 31, 2010.

The effect of this change on segmented information is stated

in Note 12. Segment Information.

Financial Section

Annual Report 2010 49