Sharp 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

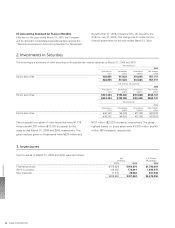

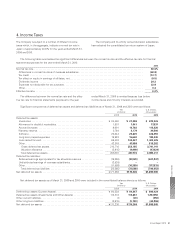

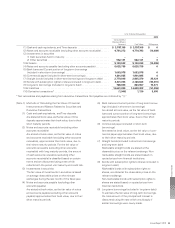

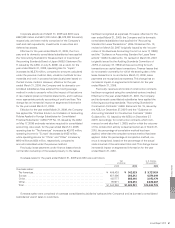

U.S. Dollars (thousands)

2010

Consolidated

Balance Sheet

Amount Fair Value Difference

(1) Cash and cash equivalents, and Time deposits . . . . . . . . . . . . . . . . . . . . . . . $ 3,787,109 $ 3,787,109 $ 0

(2) Notes and accounts receivable (excluding other accounts receivable). . . . . . 4,781,272 4,770,783 (10,489)

(3) Investments in securities

1) Debt securities held to maturity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – –

2) Other securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 562,141 562,141 0

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,130,522 9,120,033 (10,489)

(4) Notes and accounts payable (excluding other accounts payable) . . . . . . . . . . 6,025,739 6,025,739 0

(5) Bank loans and Current portion of long-term borrowings

(included in short-term borrowings) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,063,978

1,063,978

0

(6) Commercial paper (included in short-term borrowings) . . . . . . . . . . . . . . . . . 1,801,685 1,801,685 0

(7) Straight bonds (included in short-term borrowings and long-term debt) . . . . 2,779,946 2,805,370 25,424

(8) Bonds with subscription rights to shares (included in long-term debt). . . . . . 2,201,054 2,108,663 (92,391)

(9) Long-term borrowings (included in long-term debt) . . . . . . . . . . . . . . . . . . . . 788,696 803,967 15,271

Total Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,661,098 14,609,402 (51,696)

(10) Derivative transactions* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,946) 1,130 3,076

* Net receivables and payables arising from derivative transactions. Net payables are indicated by “( ).”

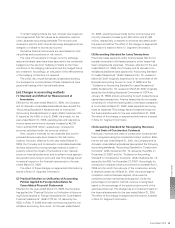

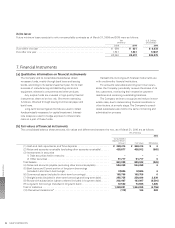

(Note 1) Methods of Calculating the Fair Value of Financial

Instruments and Matters Related to Securities and

Derivative Transactions

(1) Cash and cash equivalents, and Time deposits

Are stated at book value, as the fair value of time

deposits approximates their book value, due to their

short maturity periods.

(2) Notes and accounts receivable (excluding other

accounts receivable)

Are stated at book value, as the fair value of notes

and accounts receivable (excluding other accounts

receivable), approximates their book value, due to

their short maturity periods. For the fair value of

accounts receivable (excluding other accounts

receivable) with long maturity periods, the amount

of each accounts receivable (excluding other

accounts receivable) is classified based on certain

terms and are discounted using a rate which

reflects both the period until maturity and credit risk.

(3) Investments in securities

The fair value of investments in securities is based

on average observable prices on the relevant

exchanges during the last month of the fiscal year.

(4) Notes and accounts payable (excluding other

accounts payable)

Are stated at book value, as the fair value of notes

and accounts payable (excluding other accounts

payable) approximates their book value, due to their

short maturity periods.

(5) Bank loans and current portion of long-term borrow-

ings (included in short-term borrowings)

Are stated at book value, as the fair value of bank

loans and current portion of long-term borrowings

approximates their book value, due to their short

maturity periods.

(6) Commercial paper (included in short-term

borrowings)

Are stated at book value, as the fair value of com-

mercial paper approximates their book value, due

to their short maturity periods.

(7) Straight bonds (included in short-term borrowings

and long-term debt)

Marketable straight bonds are stated at the

observable price on the relevant exchange. Non-

marketable straight bonds are stated based on

quoted prices from financial institutions.

(8) Bonds with subscription rights to shares (included in

long-term debt)

Marketable bonds with subscription rights to

shares, are stated at the observable prices on the

relevant exchange.

Non-marketable bonds with subscription rights to

shares are stated based on quoted prices from

financial institutions.

(9) Long-term borrowings (included in long-term debt)

To estimate the fair value of long-term borrowings,

the total amount of the principal and interest is

discounted using the rate which would apply if

similar borrowings were newly made.

Financial Section

Annual Report 2010 55