Red Lobster 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

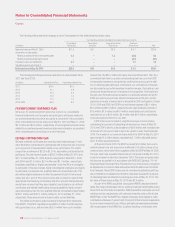

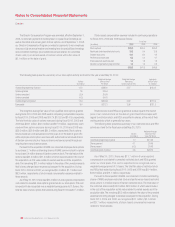

NOTE 19

COMMITMENTS AND CONTINGENCIES

As collateral for performance on contracts and as credit guarantees to banks

and insurers, we were contingently liable for guarantees of subsidiary

obligations under standby letters of credit. At May 30, 2010 and May 31,

2009, we had $97.3 million and $104.5 million, respectively, of standby

letters of credit related to workers’ compensation and general liabilities

accrued in our consolidated financial statements. At May 30, 2010 and

May 31, 2009, we had $20.1 million and $19.2 million, respectively, of

standby letters of credit related to contractual operating lease obligations

and other payments. All standby letters of credit are renewable annually.

At May 30, 2010 and May 31, 2009, we had $9.0 million and $8.8 million,

respectively, of guarantees associated with leased properties that have been

assigned to third parties. These amounts represent the maximum potential

amount of future payments under the guarantees. The fair value of these

potential payments discounted at our pre-tax cost of capital at May 30, 2010

and May 31, 2009, amounted to $6.4 million and $6.3 million, respectively.

We did not accrue for the guarantees, as the likelihood of the third parties

defaulting on the assignment agreements was deemed to be less than probable.

In the event of default by a third party, the indemnity and default clauses in our

assignment agreements govern our ability to recover from and pursue the third

party for damages incurred as a result of its default. We do not hold any third-

party assets as collateral related to these assignment agreements, except to

the extent that the assignment allows us to repossess the building and personal

property. These guarantees expire over their respective lease terms, which

range from fiscal 2011 through fiscal 2021.

We are subject to private lawsuits, administrative proceedings and claims

that arise in the ordinary course of our business. A number of these lawsuits,

proceedings and claims may exist at any given time. These matters typically

involve claims from guests, employees and others related to oper ational issues

common to the restaurant industry, and can also involve infringement of, or

challenges to, our trademarks. While the resolution of a lawsuit, proceeding

or claim may have an impact on our financial results for the period in which it

is resolved, we believe that the final disposition of the lawsuits, proceedings

and claims in which we are currently involved, either individually or in the

aggregate, will not have a material adverse effect on our financial position,

results of operations or liquidity.

NOTE 20

SUBSEQUENT EVENT

On June 22, 2010, the Board of Directors declared a cash dividend of

32 cents per share to be paid August 2, 2010 to all shareholders of record

as of the close of business on July 9, 2010.

66 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden