Red Lobster 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 33

Notes to Consolidated Financial Statements

Darden Restaurants

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 33

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

each plan at its valuation date to reflect the yield of high quality fixed-income

debt instruments, with lives that approximate the maturity of the plan benefits.

At May 30, 2010, our discount rate was 5.9 percent and 6.0 percent, respec-

tively, for our defined benefit and postretirement benefit plans. The expected

long-term rate of return on plan assets and health care cost trend rates are

based upon several factors, including our historical assumptions compared

with actual results, an analysis of current market conditions, asset allocations

and the views of leading financial advisers and economists. Our assumed

expected long-term rate of return on plan assets for our defined benefit plan

was 9.0 percent for each of the fiscal years reported. At May 30, 2010, the

expected health care cost trend rate assumed for our postretirement benefit

plan for fiscal 2011 was 8.0 percent. The rate gradually decreases to 5.0

percent through fiscal 2021 and remains at that level thereafter. We made

contributions of approximately $0.4 million, $0.5 million and $0.5 million in

fiscal years 2010, 2009 and 2008, respectively, to our defined benefit pension

plan to maintain its targeted funded status as of each annual valuation date.

Prior to fiscal 2009, our measurement date for our defined benefit and other

postretirement benefit costs and liabilities was as of our third fiscal quarter.

As of May 31, 2009, we adopted the measurement date provisions of FASB

ASC Topic 715, which requires that benefit plan assets and liabilities are

measured as of the end of the benefit plan sponsor’s fiscal year. As a result

of the change in measurement date, in accordance with the provisions of

FASB ASC Topic 715, we recognized a $0.6 million after tax charge to the

beginning balance of our fiscal 2009 retained earnings.

The expected long-term rate of return on plan assets component of our

net periodic benefit cost is calculated based on the market-related value

of plan assets. Our target asset fund allocation is 35 percent U.S. equities,

30 percent high-quality, long-duration fixed-income securities, 15 percent

international equities, 10 percent real assets and 10 percent private equities.

We monitor our actual asset fund allocation to ensure that it approximates

our target allocation and believe that our long-term asset fund allocation will

continue to approximate our target allocation. In developing our expected rate

of return assumption, we have evaluated the actual historical performance

and long-term return projections of the plan assets, which give consideration

to the asset mix and the anticipated timing of the pension plan outflows. We

employ a total return investment approach whereby a mix of equity and fixed

income investments are used to maximize the long-term return of plan assets

for what we consider a prudent level of risk. Our historical 10-year, 15-year

and 20-year rates of return on plan assets, calculated using the geometric

method average of returns, are approximately 5.8 percent, 8.8 percent and

9.4 percent, respectively, as of May 30, 2010.

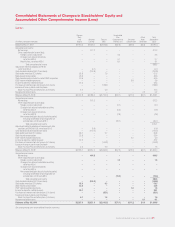

We have recognized net actuarial losses, net of tax, as a component of

accumulated other comprehensive income (loss) for the defined benefit plans

and postretirement benefit plan as of May 30, 2010 of $55.3 million and

$11.2 million, respectively. These net actuarial losses represent changes in

the amount of the projected benefit obligation and plan assets resulting from

differences in the assumptions used and actual experience. The amortization

of the net actuarial loss component of our fiscal 2011 net periodic benefit

cost for the defined benefit plans and postretirement benefit plan is expected

to be approximately $4.5 million and $1.3 million, respectively.

We believe our defined benefit and postretirement benefit plan assumptions

are appropriate based upon the factors discussed above. However, other

assumptions could also be reasonably applied that could differ from the

assumptions used. A quarter-percentage point change in the defined benefit

plans’ discount rate and the expected long-term rate of return on plan assets

would increase or decrease earnings before income taxes by $1.4 million and

$0.5 million, respectively. A quarter-percentage point change in our post-

retirement benefit plan discount rate would increase or decrease earnings

before income taxes by $0.2 million. A one-percentage point increase in the

health care cost trend rates would increase the accumulated postretirement

benefit obligation (APBO) by $8.3 million at May 30, 2010 and the aggregate

of the service cost and interest cost components of net periodic postretirement

benefit cost by $0.5 million for fiscal 2010. A one-percentage point decrease

in the health care cost trend rates would decrease the APBO by $6.5 million

at May 30, 2010 and the aggregate of the service cost and interest cost

components of net periodic postretirement benefit cost by $0.4 million for

fiscal 2010. These changes in assumptions would not significantly impact

our funding requirements.

We are not aware of any trends or events that would materially affect our

capital requirements or liquidity. We believe that our internal cash-generating

capabilities, the potential issuance of unsecured debt securities under our shelf

registration statement and short-term commercial paper should be sufficient

to finance our capital expenditures, debt maturities, stock repurchase program

and other operating activities through fiscal 2011.

OFF-BALANCE SHEET ARRANGEMENTS

We are not a party to any off-balance sheet arrangements that have, or are

reasonably likely to have, a current or future material effect on our financial

condition, changes in financial condition, sales or expenses, results of opera-

tions, liquidity, capital expenditures or capital resources.

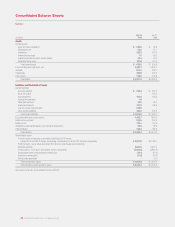

FINANCIAL CONDITION

Our total current assets were $678.5 million at May 30, 2010, compared

with $554.8 million at May 31, 2009. The increase resulted primarily from an

increase in cash and cash equivalents to fund the repayment of debt due in

August 2010, an increase in receivables, net, due to the timing of distribution,

tenant allowances and an increase in the receivable portion of the fair value

interest swap as a result of favorable interest movements, offset by a decrease

in inventory levels due to the timing of inventory purchases, a decrease in

prepaid income taxes due to prior year overpayments and a decrease in

current deferred income tax assets based on current period activity of taxable

timing differences.

Our total current liabilities were $1.25 billion at May 30, 2010, compared

with $1.10 billion at May 31, 2009. The increase in current liabilities resulted

primarily from the reclassification of long-term debt maturing within the next

year, market driven changes in fair value related to our non-qualified deferred

compensation plans, an increase in unearned revenues associated with gift cards

and an increase in accrued bonuses offset by the repayment of short-term debt.

QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations in interest

rates, foreign currency exchange rates, compensation and commodity prices.

To manage this exposure, we periodically enter into interest rate and foreign

currency exchange instruments, equity forwards and commodity instruments

for other than trading purposes (see Notes 1 and 10 of the Notes to

Consolidated Financial Statements, included elsewhere in this report and

incorporated herein by reference).