Red Lobster 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benchmark interest rate would cause variability in our forecasted interest

payments. These instruments were all settled at the issuance of the New

Senior Notes during the quarter ended August 24, 2008 for a cumulative gain

of $6.2 million. These instruments were designated as effective cash flow

hedges, therefore, the gain was recorded in accumulated other comprehen-

sive income (loss) and is reclassified into earnings as a reduction to interest

expense as interest on the New Senior Notes or similar debt is incurred.

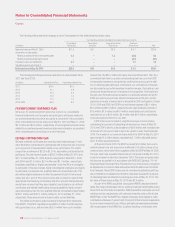

INTEREST RATE SWAPS

During fiscal 2010, we entered into interest rate swap agreements with

$375.0 million of notional value to limit the risk of changes in fair value of our

$150.0 million 4.875 percent senior notes due August 2010, $75.0 million

7.450 percent medium-term notes due April 2011, and a portion of the

$350 million 5.625 percent senior notes due October 2012 attributable to

changes in the benchmark interest rate, between now and maturity of the

related debt. The swap agreements effectively swap the fixed rate obligations

for floating rate obligations, thereby mitigating changes in fair value of the

related debt prior to maturity. The swap agreements were designated as fair

value hedges of the related debt and met the requirements to be accounted

for under the short-cut method, resulting in no ineffectiveness in the hedging

relationship. Gains and losses on the interest rate swap agreements used to

hedge the fair value of the related debt are recognized in earnings, as are

the losses and gains associated with the changes in fair value of the related

debt. In addition, the net swap settlements that accrue each period are

reported in interest expense. During the fiscal year ended May 30, 2010,

$3.4 million was recorded as a reduction to interest expense related to

these net swap settlements.

During fiscal 2009, we entered into interest rate swap agreements with

$225.0 million of notional value to limit the risk of changes in fair value of our

$150.0 million senior notes due August 2010 and $75.0 million medium-term

notes due April 2011 attributable to changes in the benchmark interest

rate, between now and maturity of the related debt. The swap agreements

effectively swap the fixed rate obligations for floating rate obligations, thereby

mitigating changes in fair value of the related debt prior to maturity. The swap

agreements were designated as fair value hedges of the related debt and met

the requirements to be accounted for under the short-cut method, resulting in

no ineffectiveness in the hedging relationship. During fiscal 2009, we ter minated

these interest rate swap agreements for a gain of approximately $1.9 million,

which will be recorded as a reduction to interest expense over the remaining

life of the related long-term debt.

During fiscal 2005 and fiscal 2004, we entered into interest rate swap

agreements to hedge the risk of changes in interest rates on the cost of a

future issuance of fixed-rate debt. The swaps, which had a $100.0 million

notional principal amount of indebtedness, were used to hedge a portion of

the interest payments associated with $150.0 million of unsecured 4.875

percent senior notes due in August 2010, which were issued in August 2005.

The swaps were settled at the time of the related debt issuance with a net

loss of $1.2 million being recognized in accumulated other comprehensive

income (loss). The net loss on the swaps is being amortized into earnings as

an adjustment to interest expense over the same period in which the related

interest costs on the related debt issuance are being recognized in earnings.

We also had interest rate swaps with a notional amount of $200.0 million,

which we used to convert variable rates on our long-term debt to fixed rates

effective May 30, 1995, related to the issuance of our $150.0 million 6.375

percent notes due February 2006 and our $100.0 million 7.125 per cent

debentures due February 2016. We received the one-month commercial

paper interest rate and paid fixed-rate interest ranging from 7.51 percent to

7.89 percent. The swaps were settled during January 1996 at a cost to us

of $27.7 million. A portion of the cost was recognized as an adjustment to

interest expense over the term of our 10-year 6.375 percent notes that were

settled at maturity in February 2006. The remaining portion continues to be

recognized as an adjustment to interest expense over the term of our 20-year

7.125 percent debentures due 2016.

EQUITY FORWARDS

We enter into equity forward contracts to hedge the risk of changes in future

cash flows associated with the unvested, unrecognized Darden stock units.

The equity forward contracts will be settled at the end of the vesting periods

of their underlying Darden stock units, which range between four and five

years. The contracts were initially designated as cash flow hedges to the

extent the Darden stock units are unvested and, therefore, unrecognized as a

liability in our financial statements. In total, the equity forward contracts are

indexed to 0.8 million shares of our common stock, at varying forward rates

between $27.57 per share and $41.17 per share and can only be net settled

in cash. To the extent the equity forward contracts are effective in offsetting

the variability of the hedged cash flows, changes in the fair value of the equity

forward contracts are not included in current earnings but are reported as

accumulated other comprehensive income (loss). As the Darden stock units

vest, we will de-designate that portion of the equity forward contract that no

longer qualifies for hedge accounting and changes in fair value associated

with that portion of the equity forward contract will be recognized in current

earnings. We periodically incur interest on the notional value of the contracts

and receive dividends on the underlying shares. These amounts are recog-

nized currently in earnings as they are incurred.

We entered into equity forward contracts to hedge the risk of changes in

future cash flows associated with employee-directed investments in Darden

stock within the non-qualified deferred compensation plan. The equity forward

contracts are indexed to 0.2 million shares of our common stock at forward

rates between $23.41 and $37.44 per share, can only be net settled in cash

and expire between fiscal 2011 and 2013. We did not elect hedge accounting

with the expectation that changes in the fair value of the equity forward

contracts would offset changes in the fair value of the Darden stock investments

in the non-qualified deferred compensation plan within selling, general and

administrative expenses in our consolidated statements of earnings.

DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT 53

Notes to Consolidated Financial Statements

Darden