Red Lobster 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

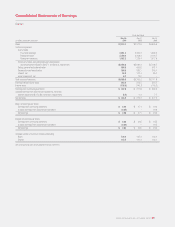

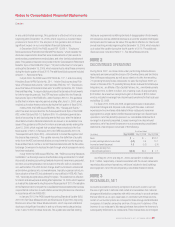

The following table presents the computation of basic and diluted

earnings per common share:

Fiscal Year

(in millions, except per share data)

2010 2009 2008

Earnings from continuing operations $407.0 $371.8 $369.5

(Loss) earnings from discontinued operations (2.5) 0.4 7.7

Net earnings $404.5 $372.2 $377.2

Averagecommonsharesoutstanding–Basic 139.3 137.4 140.4

Effect of dilutive stock-based compensation 3.1 3.0 4.7

Averagecommonsharesoutstanding–Diluted 142.4 140.4 145.1

Basic net earnings per share:

Earnings from continuing operations $ 2.92 $ 2.71 $ 2.63

(Loss) earnings from discontinued operations (0.02) – 0.06

Net earnings $ 2.90 $ 2.71 $ 2.69

Diluted net earnings per share:

Earnings from continuing operations $ 2.86 $ 2.65 $ 2.55

(Loss) earnings from discontinued operations (0.02) – 0.05

Net earnings $ 2.84 $ 2.65 $ 2.60

Restricted stock and options to purchase 3.3 million shares, 8.2 million

shares and 3.2 million shares of common stock were excluded from the

calculation of diluted net earnings per share for fiscal 2010, 2009 and 2008,

respectively, because the effect would have been anti-dilutive.

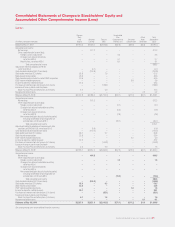

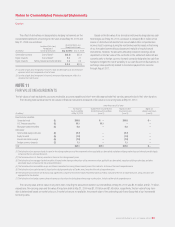

COMPREHENSIVE INCOME (LOSS)

Comprehensive income (loss) includes net earnings and other comprehensive

income (loss) items that are excluded from net earnings under U.S. generally

accepted accounting principles. Other comprehensive income (loss) items

include foreign currency translation adjustments, the effective unrealized

portion of changes in the fair value of cash flow hedges, unrealized gains and

losses on our marketable securities classified as held for sale and recognition

of the funded status and amortization of unrecognized net actuarial gains and

lossesrelatedtoourpensionandotherpostretirementplans.SeeNote13–

Stockholders’ Equity for additional information.

FOREIGN CURRENCY

The Canadian dollar is the functional currency for our Canadian restaurant

operations. Assets and liabilities denominated in Canadian dollars are

translated into U.S. dollars using the exchange rates in effect at the balance

sheet date. Results of operations are translated using the average exchange

rates prevailing throughout the period. Translation gains and losses are

reported as a separate component of accumulated other comprehensive

income (loss) in stockholders’ equity. Aggregate cumulative translation

losses were $2.2 million and $3.7 million at May 30, 2010 and May 31,

2009, respectively. Gains and losses from foreign currency transactions

were not significant for fiscal 2010, 2009 or 2008.

SEGMENT REPORTING

As of May 30, 2010, we operated the Red Lobster, Olive Garden, LongHorn

Steakhouse, The Capital Grille, Bahama Breeze and Seasons 52 restaurant

brands in North America as operating segments. The brands operate prin cipally

in the U.S. within the full-service dining industry, providing similar products to

similar customers. The brands also possess similar economic characteristics,

resulting in similar long-term expected financial performance characteristics.

Sales from external customers are derived principally from food and beverage

sales. We do not rely on any major customers as a source of sales. We believe

we meet the criteria for aggregating our operating segments into a single

reporting segment.

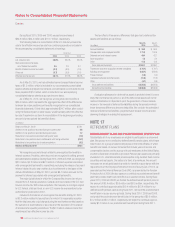

APPLICATION OF NEW ACCOUNTING STANDARDS

We have included reference to previously issued accounting guidance as it

was originally issued with reference to the ASC Topic or Subtopic where the

respective guidance has been codified within the FASB ASC.

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measurements,” which has been codified into the Fair Value Measurements

and Disclosures Topic (Topic 820) of the FASB ASC. Topic 820 defines fair value,

establishes a framework for measuring fair value and enhances disclosures

about fair value measures required under other accounting pronouncements,

but does not change existing guidance as to whether or not an instrument is

carried at fair value. For financial assets and liabilities, Topic 820 is effective

for fiscal years beginning after November 15, 2007, which required us to

adopt these provisions in fiscal 2009. For nonfinancial assets and liabilities,

Topic 820 is effective for fiscal years beginning after November 15, 2008,

which required us to adopt these provisions in fiscal 2010. The adoption

of these provisions of Topic 820 did not have a significant impact on our

con solidated financial statements.

In December 2007, the FASB issued SFAS No. 141R, “Business

Combinations,” which has been codified into the Business Combinations Topic

(Topic 805) of the FASB ASC. Topic 805 provides companies with principles

and requirements on how an acquirer recognizes and measures in its financial

statements the identifiable assets acquired, liabilities assumed, and any

noncontrolling interest in the acquiree as well as the recognition and measure-

ment of goodwill acquired in a business combination. Topic 850 also requires

certain disclosures to enable users of the financial statements to evaluate the

nature and financial effects of the business combination. Acquisition costs

associated with the business combination will generally be expensed as incurred.

The provisions in Topic 805 are effective for business combinations occurring

in fiscal years beginning after December 15, 2008, which required us to

adopt these provisions for business combinations occurring in fiscal 2010

and thereafter. This guidance was adopted at the beginning of fiscal 2010

and will be implemented for any future business combinations entered into

after the effective date. The adoption did not have a significant impact on our

consolidated financial statements.

In June 2008, the FASB issued FASB Staff Position (FSP) EITF 03-6-1,

“Determining Whether Instruments Granted in Share-Based Payment

Transactions Are Participating Securities,” which has been codified into the

Earnings Per Share Topic of the FASB ASC, within Subtopic 260-10. Subtopic

260-10 provides that unvested share-based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents (whether paid or

unpaid) are participating securities and shall be included in the computation

of earnings per share pursuant to the two-class method. The two-class method

is an earnings allocation method for computing earnings per share when an

entity’s capital structure includes either two or more classes of common stock

or common stock and participating securities. It determines earnings per share

based on dividends declared on common stock and participating securities

(i.e., distributed earnings) and participation rights of participating securities

48 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden