Red Lobster 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Notes to Consolidated Financial Statements

Darden Restaurants

30 DARDEN RESTAURANTS, INC. | 2010 ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

commitment. In April 2010, however, Lehman’s commitment was assigned to

another then-existing Revolving Credit Lender, so the aggregate commitments

available under our facility have been restored to $750.0 million. After consid-

eration of borrowings currently outstanding and letters of credit backed by the

Revolving Credit Agreement, as of May 30, 2010, we had $691.6 million of

credit available under the Revolving Credit Agreement.

On October 11, 2007, we issued $350.0 million of unsecured 5.625

percent senior notes due October 2012, $500.0 million of unsecured 6.200

percent senior notes due October 2017 and $300.0 million of unsecured

6.800 percent senior notes due October 2037 (collectively, the New Senior

Notes) under a registration statement filed with the Securities and Exchange

Commission (SEC) on October 9, 2007. Discount and issuance costs, which

were $4.3 million and $11.7 million, respectively, are being amortized over

the terms of the New Senior Notes using the straight-line method, the results

of which approximate the effective interest method. The interest rate payable

on each series of the New Senior Notes is subject to adjustment from time

to time if the debt rating assigned to the series of the New Senior Notes is

downgraded below a certain rating level (or subsequently upgraded). The

maximum adjustment is 2.000 percent above the initial interest rate and

the interest rate cannot be reduced below the initial interest rate. As of May

30, 2010, no adjustments to these interest rates had been made. We may

redeem any series of the New Senior Notes at any time in whole or from

time to time in part, at the principal amount plus a make-whole premium.

If we experience a change of control triggering event, we may be required to

purchase the New Senior Notes from the holders.

We also have $150.0 million of unsecured 4.875 percent senior notes

due in August 2010 and $75.0 million of unsecured 7.450 percent medium-

term notes due in April 2011 included in current liabilities as current portion

of long-term debt, which we plan to repay from a combination of cash on

hand, borrowing from our revolving credit facility and through the issuance

of unsecured debt securities in fiscal 2011.

All of our long-term debt currently outstanding is expected to be repaid

entirely at maturity with interest being paid semi-annually over the life of the

debt. The aggregate maturities of long-term debt for each of the five fiscal

years subsequent to May 30, 2010 and thereafter are $225.0 million in fiscal

2011, $0.0 million in fiscal 2012, $350.0 million in fiscal 2013, $0.0 million

in fiscal 2014, $0.0 million in fiscal 2015 and $1.06 billion thereafter.

During the first quarter of fiscal 2010, we entered into interest rate swap

agreements with $375.0 million of notional value to limit the risk of changes in

fair value of our $150.0 million senior notes due August 2010, $75.0 million

medium-term notes due April 2011, and a portion of the $350 million senior

notes due October 2012 attributable to changes in the benchmark interest

rate, between now and maturity of the related debt. The swap agreements

effectively swap the fixed rate obligations for floating rate obligations, thereby

mitigating changes in fair value of the related debt prior to maturity. The swap

agreements were designated as fair value hedges of the related debt and met

the requirements to be accounted for under the short-cut method, resulting

in no ineffectiveness in the hedging relationship. Gains and losses on the

interest rate swap agreements used to hedge the fair value of the related debt

are recognized in earnings, as are the losses and gains associated with the

changes in fair value of the related debt. During fiscal 2010, $3.4 million was

recognized as a reduction to interest expense.

During the fourth quarter of fiscal 2008 and the first quarter of fiscal 2009,

we entered into treasury-lock derivative instruments with $150.0 million of

notional value to hedge a portion of the risk of changes in the benchmark

interest rate associated with the expected issuance of long-term debt to

refinance our $150.0 million senior notes due August 2010 and our $75.0

million medium-term notes due April 2011, as changes in the benchmark

interest rate will cause variability in our forecasted interest payments. These

derivative instruments are designated as cash flow hedges and to the extent

they are effective in offsetting the variability of the hedged cash flows, changes

in the derivatives’ fair value are not included in current earnings but are

included in accumulated other comprehensive income (loss). These changes

in fair value will subsequently be reclassified into earnings as a component

of interest expense as interest is incurred on the forecasted debt issuance.

Ineffectiveness measured in the hedging relationship is recorded currently in

earnings in the period it occurs. The fair value of these outstanding treasury-

lock derivative instruments was a net loss of $10.5 million at May 30, 2010 and

is included, net of tax of $6.5 million, in accumulated other comprehensive

income (loss).

During the second quarter of fiscal 2008, we entered into treasury-lock

derivative instruments with $550.0 million of notional value to hedge a portion

of the risk of changes in the benchmark interest rate prior to the issuance

of the New Senior Notes, as changes in the benchmark interest rate would

cause variability in our forecasted interest payments. These instruments were

all settled at the issuance of the New Senior Notes for a cumulative gain of

$6.2 million. These instruments were designated as effective cash flow hedges,

therefore, the gain was recorded in accumulated other comprehensive income

(loss) and is reclassified into earnings as an adjustment to interest expense

as interest on the New Senior Notes or similar debt is incurred. Gains of $0.8

million and $0.8 million were recognized in earnings during fiscal 2010 and

2009, respectively, as an adjustment to interest expense.

We currently do not have any provisions in our interest rate swap,

treasury-lock or other derivative agreements that would require either

counterparty to hold or post collateral in the event that the market value of

the related derivative instrument exceeds a certain limit.

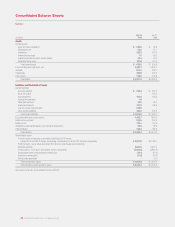

At May 30, 2010, our long-term debt consisted principally of:

•$350.0millionofunsecured5.625percentseniornotesduein

October2012;

•$100.0millionofunsecured7.125percentdebenturesduein

February2016;

•$500.0millionofunsecured6.200percentseniornotesduein

October2017;

•$150.0millionofunsecured6.000percentseniornotesduein

August2035;

•$300.0millionofunsecured6.800percentseniornotesduein

October2037;and

•Anunsecured,variablerate$9.8millioncommercialbankloandue

in December 2018 that is used to support a loan from us to the

Employee Stock Ownership Plan portion of the Darden Savings Plan.

Through our shelf registration statement on file with the SEC, depending

on conditions prevailing in the public capital markets, we may issue unsecured

debt securities from time to time in one or more series, which may consist of

notes, debentures or other evidences of indebtedness in one or more offerings.

We may from time to time repurchase our outstanding debt in privately

negotiated transactions. Such repurchases, if any, will depend on prevailing

market conditions, our liquidity requirements and other factors.