Pfizer 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 2006 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

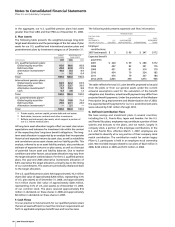

16.

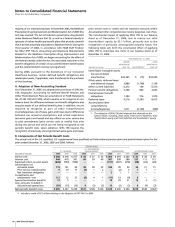

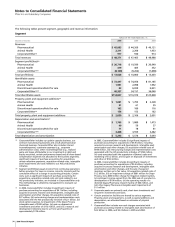

Earnings Per Common Share

Basic and diluted earnings per common share were computed

using the following common share data:

YEAR ENDED DEC. 31,

(MILLIONS) 2006 2005 2004

EPS Numerator—Basic:

Income from continuing operations

before cumulative effect of a change

in accounting principles $11,024 $7,610 $10,936

Less: Preferred stock dividends—net of tax 5 64

Income available to common share-

holders from continuing operations

before cumulative effect of a change

in accounting principles 11,019 7,604 10,932

Discontinued operations:

Income from discontinued

operations—net of tax 433 451 374

Gains on sales of discontinued

operations—net of tax 7,880 47 51

Discontinued operations—net of tax 8,313 498 425

Income available to common share-

holders before cumulative effect of

a change in accounting principles 19,332 8,102 11,357

Cumulative effect of a change in

accounting principles—net of tax — (23) —

Net income available to common

shareholders $19,332 $8,079 $11,357

EPS Denominator—Basic:

Weighted average number of

common shares outstanding 7,242 7,361 7,531

EPS Numerator—Diluted:

Income from continuing operations

before cumulative effect of a change

in accounting principles $11,024 $7,610 $10,936

Less: ESOP contribution—net of tax 3 55

Income available to common share-

holders from continuing operations

before cumulative effect of a change

in accounting principles 11,021 7,605 10,931

Discontinued operations:

Income from discontinued

operations—net of tax 433 451 374

Gains on sales of discontinued

operations—net of tax 7,880 47 51

Discontinued operations—net of tax 8,313 498 425

Income available to common share-

holders before cumulative effect of

a change in accounting principles 19,334 8,103 11,356

Cumulative effect of a change in

accounting principles—net of tax — (23) —

Net income available to common

shareholders $19,334 $8,080 $11,356

EPS Denominator—Diluted:

Weighted-average number of

common shares outstanding 7,242 7,361 7,531

Common share equivalents—stock

options, stock issuable under

employee compensation plans and

convertible preferred stock 32 50 83

Weighted-average number of

common shares outstanding

and common share equivalents 7,274 7,411 7,614

Stock options and stock issuable under employee compensation

plans representing equivalents of 552 million shares of common

stock during 2006, 557 million shares of common stock during 2005

and 359 million shares of common stock during 2004 had exercise

prices greater than the annual average market price of our

common stock. These common stock equivalents were outstanding

during 2006, 2005 and 2004, but were not included in the

computation of diluted earnings per common share for those years

because their inclusion would have had an anti-dilutive effect.

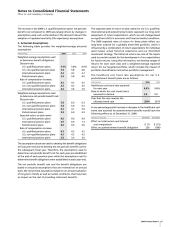

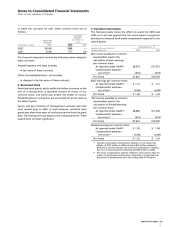

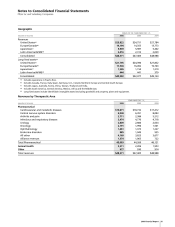

17. Lease Commitments

We lease properties and equipment for use in our operations. In

addition to rent, the leases may require us to pay directly for taxes,

insurance, maintenance and other operating expenses, or to pay

higher rent when operating expenses increase. Rental expense,

net of sublease income, was $420 million in 2006, $410 million in

2005 and $438 million in 2004. This table shows future minimum

rental commitments under noncancellable operating leases as of

December 31 for the following years:

AFTER

(MILLIONS OF DOLLARS) 2007 2008 2009 2010 2011 2011

Lease commitments $229 $200 $174 $113 $72 $524

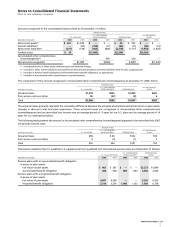

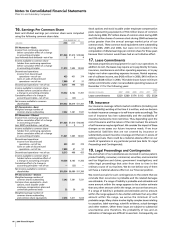

18.

Insurance

Our insurance coverage reflects market conditions (including cost

and availability) existing at the time it is written, and our decision

to obtain insurance coverage or to self-insure varies accordingly. The

cost of insurance has risen substantially and the availability of

insurance has become more restrictive. Thus, depending upon the

cost of insurance and the nature of the risk involved, the amount

of self-insurance may be significant. We consider the impact of these

changes as we assess our future insurance needs. If we incur

substantial liabilities that are not covered by insurance or

substantially exceed insurance coverage and that are in excess of

existing accruals, there could be a material adverse effect on our

results of operations in any particular period (see Note 19. Legal

Proceedings and Contingencies).

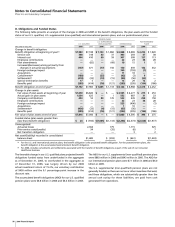

19. Legal Proceedings and Contingencies

We and certain of our subsidiaries are involved in various patent,

product liability, consumer, commercial, securities, environmental

and tax litigations and claims; government investigations; and

other legal proceedings that arise from time to time in the

ordinary course of our business. We do not believe any of them

will have a material adverse effect on our financial position.

We record accruals for such contingencies to the extent that we

conclude their occurrence is probable and the related damages

are estimable. If a range of liability is probable and estimable and

some amount within the range appears to be a better estimate

than any other amount within the range, we accrue that amount.

If a range of liability is probable and estimable and no amount

within the range appears to be a better estimate than any other

amount within the range, we accrue the minimum of such

probable range. Many claims involve highly complex issues relating

to causation, label warnings, scientific evidence, actual damages

and other matters. Often these issues are subject to substantial

uncertainties and, therefore, the probability of loss and an

estimation of damages are difficult to ascertain. Consequently, we