Pfizer 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 2006 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

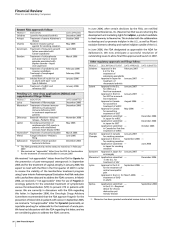

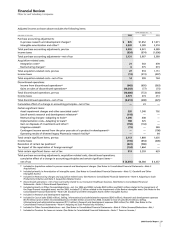

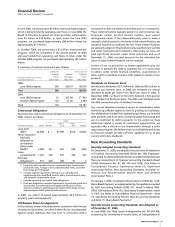

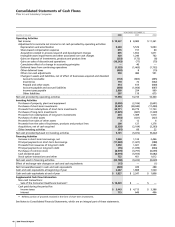

Summary of Cash Flows

YEAR ENDED DEC. 31,

_________________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

Cash provided by/(used in):

Operating activities $ 17,594 $14,733 $16,340

Investing activities 5,101 (5,072) (9,422)

Financing activities (23,100) (9,222) (6,629)

Effect of exchange-rate

changes on cash and cash

equivalents (15) — (1)

Net increase/(decrease) in cash

and cash equivalents $ (420) $ 439 $ 288

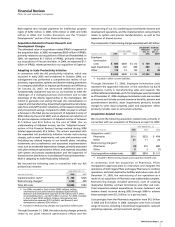

Operating Activities

Our net cash provided by continuing operating activities was

$17.6 billion in 2006, as compared to $14.7 billion in 2005. The

increase in net cash provided by operating activities was primarily

attributable to:

•

the payment of $1.7 billion in taxes in 2005 associated with the

repatriation of approximately $37 billion of foreign earnings

under the Jobs Act in 2005; and

•

the timing of other receipts and payments in the ordinary

course of business.

Our net cash provided by continuing operating activities was

$14.7 billion in 2005, as compared to $16.3 billion in 2004. The

decrease in net cash provided by operating activities was primarily

attributable to:

•

the payment of $1.7 billion in taxes associated with the

repatriation of approximately $37 billion of foreign earnings

under the Jobs Act; and

•

the timing of other receipts and payments in the ordinary

course of business.

The estimated net cash flows provided by operating activities

associated with discontinued operations were not significant.

In 2006, the cash flow line item called Income taxes payable of $2.9

billion primarily reflects the taxes provided on the gain on the sale

of our Consumer Healthcare business that have not yet been paid.

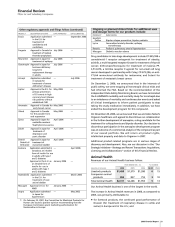

Investing Activities

Our net cash provided by investing activities was $5.1 billion in

2006, as compared to net cash used by investing activities of $5.1

billion in 2005. The increase in net cash provided by investing

activities was primarily attributable to:

•

higher net redemptions of short-term investments in 2006 (an

increased source of cash of $12.4 billion), primarily used to pay

down short-term borrowings,

partially offset by:

•

an increase in net purchases of long-term investments (an

increased use of cash of $2.3 billion); and

•

the acquisition of PowderMed Ltd., Rinat and sanofi-aventis’

rights to Exubera in 2006 compared to the acquisition of

Vicuron and Idun in 2005 (an increased use of cash of $216

million).

Our net cash used by investing activities was $5.1 billion in 2005,

as compared to $9.4 billion in 2004. The decrease in net cash used

by investing activities was primarily attributable to:

•

a decrease in net purchases of investments (a decreased use of

$4.9 billion), due primarily to higher redemptions of investments

in 2005 to provide funds for the repatriation of foreign earnings

in accordance with the Jobs Act; and

•

lower purchases of plant, property and equipment (a decreased

use of $495 million),

partially offset by:

•

lower proceeds from the sales of businesses, product lines and

other products (a decreased source of cash of $1.1 billion).

The estimated net cash flows used in investing activities associated

with discontinued operations were not significant.

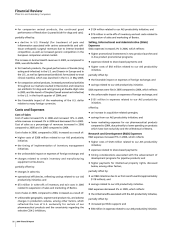

Financing Activities

Our net cash used in financing activities increased to $23.1 billion

in 2006, as compared to $9.2 billion in 2005. The increase in net

cash used in financing activities was primarily attributable to:

•

net repayments of $9.9 billion on total borrowings in 2006, as

compared to $321 million in 2005;

•

an increase in cash dividends paid of $1.4 billion in 2006, as

compared to 2005, primarily due to an increase in the dividend

rate; and

•

higher purchases of common stock in 2006 of $7.0 billion, as

compared to $3.8 billion in 2005,

partially offset by:

•

higher proceeds of $243 million from the exercise of employee

stock options.

Our net cash used in financing activities increased to $9.2 billion

in 2005, as compared to $6.6 billion in 2004. The increase in net

cash used in financing activities was primarily attributable to:

•

net repayments of $321 million on total borrowings in 2005, as

compared to total net borrowings of $4.1 billion in 2004, as

funds from the repatriation of foreign earnings in 2005 were

used to finance domestic activities, thereby reducing our

reliance on short-term borrowings;

•

an increase in cash dividends paid of $473 million, as compared

to 2004, primarily due to an increase in the dividend rate; and

•

a decrease of $610 million in the proceeds from the exercise of

employee stock options,

partially offset by:

•

lower purchases of common stock in 2005 of $3.8 billion, as

compared to $6.7 billion in 2004.

The estimated net cash flows used in financing activities associated

with discontinued operations were not significant.