Pfizer 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 2006 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

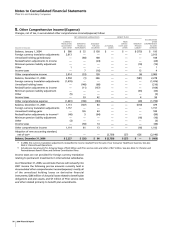

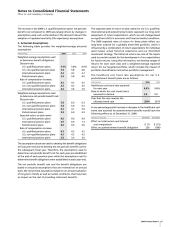

Income taxes are not provided for foreign currency translation

relating to permanent investments in international subsidiaries.

As of December 31, 2006, we estimate that we will reclassify into

2007 income the following pre-tax amounts currently held in

Accumulated other comprehensive income/(expense): mostly all

of the unrealized holding losses on derivative financial

instruments; $266 million of Actuarial losses related to benefit plan

obligations and plan assets; and $7 million of Prior service costs

and other related primarily to benefit plan amendments.

8.

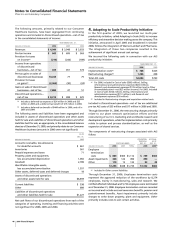

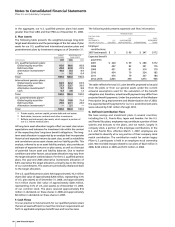

Other Comprehensive Income/(Expense)

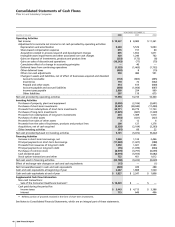

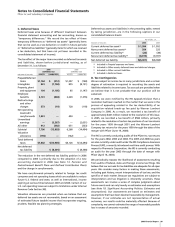

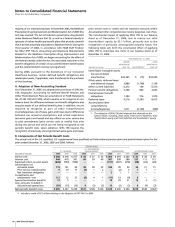

Changes, net of tax, in accumulated other comprehensive income/(expense) follow:

NET UNREALIZED GAINS/(LOSSES) BENEFIT PLANS

___________________________________________ _______________________________________________________________

ACCUMULATED

CURRENCY PRIOR OTHER

TRANSLATION DERIVATIVE AVAILABLE- SERVICE MINIMUM COMPREHENSIVE

ADJUSTMENT FINANCIAL FOR-SALE ACTUARIAL COSTS AND PENSION INCOME/

(MILLIONS OF DOLLARS) AND OTHER INSTRUMENTS SECURITIES LOSSES OTHER LIABILITY (EXPENSE)

Balance, January 1, 2004 $ 580 $ 52 $ 138 $ — $ — $ (575) $ 195

Foreign currency translation adjustments 2,013—————2,013

Unrealized holding gains/(losses) — (60) 168———108

Reclassification adjustments to income — — (24) — — — (24)

Minimum pension liability adjustment —————(19) (19)

Other 1 ————— 1

Income taxes — 7 (16) — — 13 4

Other comprehensive income 2,014 (53) 128 — — (6) 2,083

Balance, December 31, 2004 2,594 (1) 266 — — (581) 2,278

Foreign currency translation adjustments (1,476) —————(1,476)

Unrealized holding losses — (148) (68) — — — (216)

Reclassification adjustments to income — (11) (157) — — — (168)

Minimum pension liability adjustment —————(33) (33)

Other (5) ————— (5)

Income taxes — 53 42 — — 4 99

Other comprehensive expense (1,481) (106) (183) — — (29) (1,799)

Balance, December 31, 2005 1,113 (107) 83 — — (610) 479

Foreign currency translation adjustments 1,157—————1,157

Unrealized holding gains — 126 63 — — — 189

Reclassification adjustments to income

(a)

(40) 5 (64) — — — (99)

Minimum pension liability adjustment —————(16) (16)

Other (3) ————— (3)

Income taxes — (50) 14——— (36)

Other comprehensive income 1,114 81 13 — — (16) 1,192

Adoption of new accounting standard,

net of tax

(b)

— — — (2,739) (27) 626 (2,140)

Balance, December 31, 2006 $ 2,227 $ (26) $ 96 $ (2,739) $ (27) $ — $ (469)

(a)

In 2006, the currency translation adjustments reclassified to income resulted from the sale of our Consumer Healthcare business. See also

Note 3. Discontinued Operations.

(b)

Includes pre-tax amounts for Actuarial losses of $4.3 billion and Prior service costs and other of $27 million. See also Note 13. Pension and

Postretirement Benefit Plans and Defined Contribution Plans.