Pfizer 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

realize the projected benefits of our Adapting to Scale multi-

year productivity initiative, including the projected benefits of

the broadening of this initiative over the next few years.

We cannot guarantee that any forward-looking statement will be

realized, although we believe we have been prudent in our plans

and assumptions. Achievement of anticipated results is subject to

substantial risks, uncertainties and inaccurate assumptions. Should

known or unknown risks or uncertainties materialize, or should

underlying assumptions prove inaccurate, actual results could

vary materially from past results and those anticipated, estimated

or projected. Investors should bear this in mind as they consider

forward-looking statements.

We undertake no obligation to publicly update forward-looking

statements, whether as a result of new information, future events

or otherwise. You are advised, however, to consult any further

disclosures we make on related subjects in our Forms 10-Q, 8-K

and 10-K reports to the Securities and Exchange Commission.

Certain risks, uncertainties and assumptions are discussed here and

under the heading entitled “Risk Factors and Cautionary Factors

That May Affect Future Results” in Item 1A of our Annual Report

on Form 10-K for the year ended December 31, 2006, which will

be filed in February 2007. We note these factors for investors as

permitted by the Private Securities Litigation Reform Act of 1995.

You should understand that it is not possible to predict or identify

all such factors. Consequently, you should not consider any such

list to be a complete set of all potential risks or uncertainties.

This report includes discussion of certain clinical studies relating

to various in-line products and/or product candidates. These

studies typically are part of a larger body of clinical data relating

to such products or product candidates, and the discussion herein

should be considered in the context of the larger body of data.

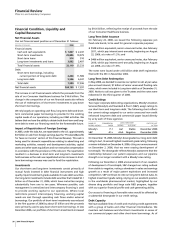

Financial Risk Management

The overall objective of our financial risk management program

is to seek a reduction in the potential negative earnings effects

from changes in foreign exchange and interest rates arising in our

business activities. We manage these financial exposures through

operational means and by using various financial instruments.

These practices may change as economic conditions change.

Foreign Exchange Risk—A significant portion of our revenues and

earnings is exposed to changes in foreign exchange rates. We seek

to manage our foreign exchange risk in part through operational

means, including managing same currency revenues in relation to

same currency costs, and same currency assets in relation to same

currency liabilities.

Foreign exchange risk is also managed through the use of foreign

currency forward-exchange contracts. These contracts are used to

offset the potential earnings effects from mostly intercompany

short-term foreign currency assets and liabilities that arise from

operations. We also use foreign currency forward-exchange

contracts and foreign currency swaps to hedge the potential

earnings effects from short and long-term foreign currency

investments, third-party loans and intercompany loans.

In addition, under certain market conditions, we protect against

possible declines in the reported net assets of our Japanese yen,

Swedish krona and certain euro functional-currency subsidiaries.

In these cases, we use currency swaps or foreign currency debt.

Our financial instrument holdings at year-end were analyzed to

determine their sensitivity to foreign exchange rate changes.

The fair values of these instruments were determined as follows:

• foreign currency forward-exchange contracts and currency

swaps—net present values

• foreign receivables, payables, debt and loans—changes in

exchange rates

In this sensitivity analysis, we assumed that the change in one

currency’s rate relative to the U.S. dollar would not have an

effect on other currencies’ rates relative to the U.S. dollar. All other

factors were held constant.

If there were an adverse change in foreign exchange rates of 10%,

the expected effect on net income related to our financial

instruments would be immaterial. For additional details, see

Notes to Consolidated Financial Statements—Note 9D. Financial

Instruments: Derivative Financial Instruments and Hedging

Activities.

Interest Rate Risk—Our U.S. dollar interest-bearing investments,

loans and borrowings are subject to interest rate risk. We are also

subject to interest rate risk on euro investments and currency

swaps, Swedish krona currency swaps, and on Japanese yen short

and long-term borrowings and currency swaps. We invest and

borrow primarily on a short-term or variable-rate basis. From

time to time, depending on market conditions, we will fix interest

rates either through entering into fixed-rate investments and

borrowings or through the use of derivative financial instruments

such as interest rate swaps.

Our financial instrument holdings at year-end were analyzed to

determine their sensitivity to interest rate changes. The fair values

of these instruments were determined by net present values.

In this sensitivity analysis, we used the same change in interest rate

for all maturities. All other factors were held constant.

If there were an adverse change in interest rates of 10%, the

expected effect on net income related to our financial instruments

would be immaterial.

Legal Proceedings and Contingencies

We and certain of our subsidiaries are involved in various patent,

product liability, consumer, commercial, securities, environmental

and tax litigations and claims; government investigations; and

other legal proceedings that arise from time to time in the

ordinary course of our business. We do not believe any of them

will have a material adverse effect on our financial position.

We record accruals for such contingencies to the extent that we

conclude their occurrence is probable and the related damages

are estimable. If a range of liability is probable and estimable and

some amount within the range appears to be a better estimate

than any other amount within the range, we accrue that amount.

If a range of liability is probable and estimable and no amount

within the range appears to be a better estimate than any other

amount within the range, we accrue the minimum of such

probable range. Many claims involve highly complex issues relating

2006 Financial Report 33

Financial Review

Pfizer Inc and Subsidiary Companies