Pepsi 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All over the world, whether it’s Cedar Rapids or

Calgary, Shanghai or São Paulo, Mexico City,

Moscow or Mumbai, our associates draw strength

and inspiration from this shared mission. This

year’s annual report brings some of their stories

to life. It shows how performance and purpose

combine to great effect in everything we do.

When times are tough it is especially important to

be clear about your mission. By any measure, 2008

was a year of extremes, an incredibly volatile year.

Easy credit turned into a credit crunch that left

many businesses and consumers strapped for cash.

The global economy lurched rapidly into recession. Oil

prices approached $150 a barrel before returning back

below $40. Corn, sugar, oats and other key commod-

ities saw signicant price swings throughout the year.

Global business was made harder by foreign exchange

rates that uctuated, at times wildly. The Dow Jones

Index began 2008 above 13,000 and ended the year

below 9,000. That dragged down even the strongest

companies’ stock—including PepsiCo shares.

All told, I can’t recall a more eventful or trying year.

Not that I think pessimism is in order. The ingenuity

of our company showed through again. All our teams

of extraordinary people applied their can-do spirit and

must-do sense of responsibility to meet the economic

and market challenges head on.

As a result, PepsiCo performed slightly better for

the year than both the Dow Jones Industrial Average

and the S&P 500. I believe that’s because, while we

can’t control market volatility, we remained focused

on our strategies for growth, and that is why our

underlying businesses continued to perform very

well in 2008.

We increased our dividend, continued our share

repurchase program and positioned ourselves for

even stronger performance as economic conditions

improve.

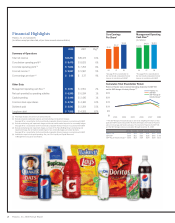

• Net revenue grew 10%.

• Core division operating prot grew 6%.*

• Cash ow from operations was $7 billion.

• Core return on invested capital was 29%.

• Core EPS grew 9%.*

In PepsiCo Americas Foods we had another year

of strong growth to both the top and the bottom lines.

That is testament to our strong brands and our efcient

go-to-market systems. This year brought unprece-

dented cost ination, but we carefully adjusted our

pricing and the weights and package formats across

our brands to nd the right solution for each channel,

each market, each customer and each consumer.

The year presented some other unexpected problems

that we coped with well. Our agship Quaker plant in

Cedar Rapids, Iowa, experienced a major ood but

returned to normal production levels by year-end. In

Latin America, our Brazil snacks business overcame a

re at one of our major plants to perform really well.

We also refreshed the product portfolio. Frito-Lay

North America introduced TrueNorth nut snacks and

entered a joint venture that offers Sabra refrigerated

dips. Some of our established products powered on.

The Quaker business and our market-leading Sabritas

and Gamesa brands helped us generate tremendous

growth. On these strengths, PepsiCo Americas Foods

increased revenues by 11 percent and core operating

prot by 10 percent.*

PepsiCo Americas Beverages had a difcult

year. In North America, our beverage volume was not

immune to the overall category weakness triggered

by the weak U.S. economy. As a result, PepsiCo

Americas Beverages revenues declined by 1 percent

and core operating prot fell by 7 percent.* But

PepsiCo has proved time and again our skill in

anticipating and responding to market changes and

consumer preferences. Liquid refreshment beverages

in the United States declined in 2008 for the rst

time in more than 50 years. We acted quickly and

decisively to refresh the category. We refreshed

the look of our iconic brands Pepsi-Cola, Mtn Dew,

Sierra Mist and Gatorade. In Latin America, where

we achieved strong results, we introduced SoBe Life,

the world’s rst beverage made with PureViaTM, an

all-natural, zero-calorie sweetener; and early in 2009,

we launched SoBe Lifewater with PureVia in the

United States.

*Forareconciliationtothemostdirectlycomparablenancialmeasureinaccordance

with GAAP, see page 95. 5PepsiCo, Inc. 2008 Annual Report