Office Depot 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Office Depot, Inc. and Subsidiaries

41

Employee Stock Purchase Plan

The Employee Stock Purchase Plan, which was approved by the Company’s

stockholders, effective July 1999, permits eligible employees to purchase

our common stock at 85% of its fair market value. A similar plan is

available to employees in the United Kingdom. Effective April 2002, share

needs under this plan are now satisfied through open market purchases.

However, the Company is authorized to issue up to 1,862,843 shares

under this plan.

Retirement Savings Plans

The Office Depot retirement savings plan, which was approved by the

Board of Directors, allows eligible employees to contribute up to 18% of

their salary, commissions and bonuses, up to $11,000 annually, to the

plan on a pretax basis in accordance with the provisions of Section 401(k)

of the Internal Revenue Code. Matching contributions of common stock

that are made into the plan are equivalent to 50% of the first 6% of

an employee’s contributions. However, discretionary matching common

stock contributions in addition to the normal match may be made. A

separate, but identical, retirement savings plan is offered to employees

of 4Sure.com. The Company also has a deferred compensation plan that

permits eligible employees who are limited in the amount they can

contribute to the 401(k) plan to alternatively make tax-deferred contri-

butions of up to 18% of their salary, commissions and bonuses to this

plan. Matching contributions to the deferred compensation plan are

similar to those under our 401(k) retirement savings plan described above.

During 2002, 2001, and 2000, $8.4 million, 4.0 million and 5.8 million,

respectively, was recorded as compensation expense under these programs.

Note J—Capital Stock

Preferred Stock

As of December 28, 2002, there were 1,000,000 shares of $.01 par value

preferred stock authorized of which none are issued or outstanding.

Stockholder Rights Plan

Effective September 4, 1996, the Company adopted a Stockholder

Rights Plan (the “Rights Plan”). Under this Rights Plan, each stockholder

is issued one right to acquire one one-thousandth of a share of Junior

Participating Preferred Stock, Series A at an exercise price of $63.33,

subject to adjustment, for each outstanding share of Office Depot com-

mon stock they own. These rights are only exercisable if a single person

or company were to acquire 20% or more of our outstanding common

stock or if the Company announced a tender or exchange offer that

would result in 20% or more of our common stock being acquired.

If the Company were acquired, each right, except those of the acquirer,

can be exchanged for shares of common stock in the Company with a

market value of twice the exercise price of the right. In addition, if the

Company becomes involved in a merger or other business combination

where (1) the Company was not the surviving company, (2) the Company’s

common stock was changed or exchanged, or (3) 50% or more of the

Company’s assets or earning power was sold, then each right, except

those of the acquirer, and an amount equal to the exercise price of the

right can be exchanged for shares of the Company’s common stock

with a market value of twice the exercise price of the right.

The Company may redeem the rights for $0.01 per right at any time

prior to an acquisition.

Treasury Stock

During 2000, under a program approved by the Board of Directors, the

Company repurchased 35.4 million shares of stock at a total cost of

$300.8 million. In 2001, the Board approved stock repurchases of up to

$50 million per year until cancelled by the Board, subject to their annual

review. Approximately 252,000 shares were purchased under this program

in 2001 for a total cost of $4.2 million. During 2002, 2.9 million shares

were purchased under this program at a total cost of $45.9 million.

Note K—Earnings Per Share

Basic earnings per share is based on the weighted average number

of shares outstanding during each period. Diluted earnings per share

further assumes that the zero coupon, convertible subordinated notes,

if outstanding and dilutive, are converted as of the beginning of the

period and that, under the treasury stock method, dilutive stock options

are exercised. Net earnings under this assumption have been adjusted

for interest on the zero coupon, convertible subordinated notes when

outstanding, net of the related income tax effect.

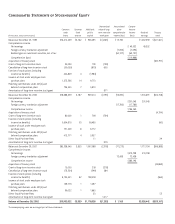

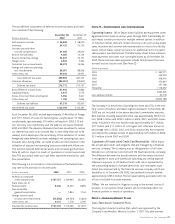

The following is a summary of the Company’s equity compensation plans:

Number of securities to be issued Number of securities

upon exercise of outstanding Weighted average remaining available

Plan options, warrants, and rights exercise price for future issuance

Long-Term Equity Incentive Plan (including the

Long-Term Incentive Stock Plan)(1) 31,499,632 $14.69 9,436,540

Employee Stock Purchase Plan (ESPP) Not Applicable Not Applicable 1,862,843(2)

Retirement Savings Plans Not Applicable Not Applicable Not Applicable(2)

(1) Outstanding options under the Long-Term Incentive Stock Plan are satisfied upon exercise with available securities from the Long-Term Equity Incentive Plan.

(2) Effective April 2002, the Company now settles share needs under the ESPP, the 401(k) Plan, and related deferred compensation plan, by open market purchases through the

respective plan administrators.