Office Depot 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

location might be impaired. Management judgment is required to ensure

the projected cash flow assumptions are based on reasonable and appro-

priate assumptions. If different assumptions were used, the extent and

timing of facility closure costs and asset impairments could be affected.

Any impairment charges required are included as a component of the

related segment’s operating and selling expenses.

Significant Trends, Developments and Uncertainties

Over the years, we have seen continued development and growth of com-

petitors in all segments of our business. In particular, mass merchandisers

and warehouse clubs have increased their assortment of home office

merchandise, attracting additional back-to-school customers and year-

round casual shoppers. We also face competition from other office

supply superstores that compete directly with us in numerous markets.

This competition is likely to result in increased competitive pressures

on pricing, product selection and services provided. Many of these retail

competitors, including discounters, warehouse clubs, and even drug

stores and grocery chains, carry at least limited numbers of basic office

supply products, including ink jet and toner cartridges, printer paper and

other basic supplies. Some of them have also begun to feature technol-

ogy products. Many of them price these offerings lower than we do, but

they have not shown an indication of greatly expanding their somewhat

limited product offerings at this time. This trend towards a proliferation

of retailers offering a limited assortment of office products is a poten-

tially serious trend in our industry, and one that our management is

watching closely.

We have also seen growth in new and innovative competitors that offer

office products over the Internet, featuring special purchase incentives

and one-time deals (such as close-outs). Through our own successful

Internet and business-to-business web sites, we believe that we have

positioned ourselves competitively in the e-commerce arena.

Market Sensitive Risks and Positions

We have market risk exposure related to interest rates and foreign cur-

rency exchange rates. Market risk is measured as the potential negative

impact on earnings, cash flows or fair values resulting from a hypotheti-

cal change in interest rates or foreign currency exchange rates over the

next year. We manage the exposure to market risks at the corporate

level. The portfolio of interest-sensitive assets and liabilities is monitored

and adjusted to provide liquidity necessary to satisfy anticipated short-

term needs. The percentage of fixed and variable rate debt is managed to

fall within a desired range. Our risk management policies allow the use

of specified financial instruments for hedging purposes only; speculation

on interest rates or foreign currency rates is not permitted.

Interest Rate Risk

We are exposed to the impact of interest rate changes on cash equiv-

alents and debt obligations. The impact on cash and short-term invest-

ments held at the end of 2002 for a hypothetical 10% decrease in

interest rates would be a decrease in interest income of approximately

$2 million in 2003.

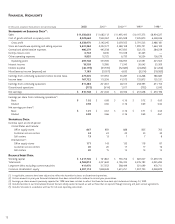

Market risk associated with our debt portfolio is summarized below:

2002 2001

Carrying Fair Risk Carrying Fair Risk

(Dollars in thousands) Value Value Sensitivity Value Value Sensitivity

Fixed interest rate debt(1) $262,213 $279,625 $6,174 $481,107 $531,602 $6,770

Variable interest rate debt(1 ) $ 81,415 $ 81,415 $ 407 $ 74,509 $ 74,509 $ 373

(1) Including current maturities.

The risk sensitivity of fixed rate debt reflects the estimated increase in

fair value from a 50 basis point decrease in interest rates, calculated on

a discounted cash flow basis. The sensitivity of variable rate debt reflects

the possible increase in interest expense during the next period from a

50 basis point change in interest rates prevailing at year-end.

During 2001, we entered into an interest rate swap agreement to receive

fixed and pay floating rates, converting the equivalent of $250 million

of this portfolio to variable rate debt through 2008. The fair value of this

agreement at December 29, 2001 was immaterial and the swap agree-

ment was terminated during 2002.

Foreign Exchange Rate Risk

We conduct business in various countries outside the United States

where the functional currency of the country is not the U.S. dollar. This

results in foreign exchange translation exposure when results of these

foreign operations are translated into U.S. dollars in our consolidated

financial statements. The effect of changes in value of the U.S. dollar

compared to other currencies, primarily the euro and British pound, has

been to increase reported sales and operating profit when the U.S. dollar

weakens and reduce these amounts when the dollar strengthens. While

we look for opportunities to reduce our exposure to foreign currency

fluctuation against the U.S. dollar, at this point we have determined not

to pursue hedging opportunities generally. As of December 28, 2002, a

10% change in the applicable foreign exchange rates would result in an

increase or decrease in our operating profit of approximately $10 million.

We are also subject to foreign exchange transaction exposure when our

subsidiaries transact business in a currency other than their own func-

tional currency. This exposure arises primarily from a limited amount of

inventory purchases in a foreign currency. The introduction of the euro

and our decision to consolidate our European purchases has greatly

reduced these exposures. At each period during 2002, foreign exchange

forward contracts to hedge certain inventory exposures totaled less than

$39 million.