Office Depot 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for the grants of stock options and other incentive awards, including

restricted stock, to directors, officers and key employees. Under this plan,

stock options must be granted at an option price that is greater than or

equal to the market price of the stock on the date of the grant. If an

employee owns at least 10% of the Company’s outstanding common

stock, the option price must be at least 110% of the market price on the

date of the grant. Options granted under this plan become exercisable

from one to five years after the date of grant, provided that the individ-

ual is continuously employed with the Company. All options granted

expire no more than 10 years following the date of grant.

To date under this plan, 331,193 shares of restricted stock were issued

at no cost to the employees, 63,565 of which have been canceled and

170,000 remain outstanding but restricted. The fair market value of these

awards approximated $4.1 million at the date of the grants. Restricted

stock issued under this plan may have vesting periods of up to four

years from the date of grant. Compensation expense is recognized on

a straight-line basis over the vesting period.

In April 2002, stockholders approved an amendment to the plan allowing

the Compensation Committee of the Board of Directors to grant perform-

ance-based shares to our senior executives and directors. Performance-

based shares are used as an incentive to increase shareholder returns with

actual awards based on the Company’s Total Shareholder Return over a

three-year period, compared against the industry peer group. Compensa-

tion expense for the anticipated number of shares to be issued, if any,

will be recognized over the vesting period. Depending on actual Company

performance, shares issued may be more or less than amounts assigned.

As of December 28, 2002, target awards of 258,250 shares have been

assigned, but no performance-based shares have been issued.

Tax benefits are recorded based on an estimate of stock options activity.

Each year, the prior year’s estimated tax benefit is adjusted based on

the actual stock sold during the year. Tax benefits received in excess of

compensation expense recorded on nonqualified stock options are cred-

ited to additional paid-in capital.

Long-Term Incentive Stock Plan

Prior to our merger with Viking Office Products (“Viking”) in 1998, Viking’s

Long-Term Incentive Stock Plan allowed awards of up to 2,400,000

restricted shares of common stock to key Viking employees. Under this

plan, 1,845,000 shares were issued at no cost to employees, of which

1,380,000 have been canceled or the restrictions satisfied, leaving 465,000

restricted shares outstanding. Pursuant to the merger agreement, shares

issued under this plan were converted to Office Depot common stock,

and no additional shares may be issued under the plan. The fair market

value of these restricted stock awards approximated $10.0 million at the

date of the grants. Prior to the merger, the vesting period was 15 years.

Because of the plan’s change in control provision, however, the employees

now vest in their stock ratably over the 15-year period. Compensation

expense is recognized on a straight-line basis over the vesting period.

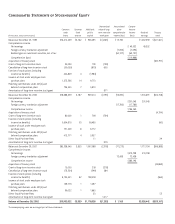

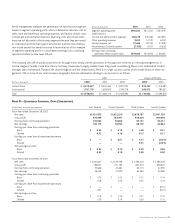

A summary of the status of and changes in our stock option plans for the last three years is presented below.

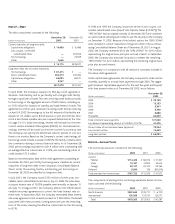

2002 2001 2000

Weighted Weighted Weighted

Average Average Average

Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding at beginning of year 35,750,521 $13.46 36,406,229 $12.81 33,507,066 $15.31

Granted 6,926,250 16.39 7,509,000 10.63 9,937,750 8.73

Canceled (3,014,831) 14.74 (2,642,428) 13.99 (6,608,072) 16.45

Exercised (8,162,308) 10.80 (5,522,280) 7.93 (430,515) 6.18

Outstanding at end of year 31,499,632 $14.69 35,750,521 $13.46 36,406,229 $12.81

As of December 28, 2002, the weighted average fair values of options granted during 2002, 2001, and 2000 were $6.38, $4.21, and $4.18, respectively.

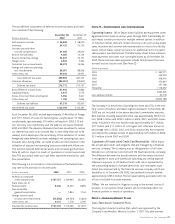

The following table summarizes information about options outstanding at December 28, 2002.

Options Outstanding Options Exercisable

Weighted Average Weighted Weighted

Range of Number Remaining Contractual Average Number Average

Exercise Prices Outstanding Life (in years) Exercise Price Exercisable Exercise Price

$ 0.17–$ 1.95 5,400 2.5 $ 0.17 5,400 $ 0.17

1.96– 2.94 — — — — —

2.95– 4.42 3,000 — 4.04 3,000 4.04

4.43– 6.64 375,360 6.9 6.30 235,983 6.24

6.65– 9.97 7,326,314 7.5 8.49 2,153,301 8.71

9.98– 14.96 6,101,702 5.8 11.66 4,183,239 11.98

14.97– 22.45 15,707,776 6.2 17.76 8,563,456 18.37

22.46– 25.00 1,980,080 5.7 24.19 1,649,580 24.20

$ 0.17–$25.00 31,499,632 6.4 $14.69 16,793,959 $15.93