Office Depot 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

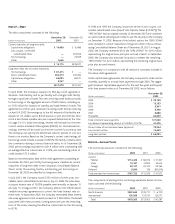

The fair value of each stock option granted is established on the date of

the grant using the Black-Scholes option-pricing model, with the follow-

ing weighted average assumptions for grants in 2002, 2001 and 2000:

•Risk-free interest rates of 4.69% for 2002, 4.58% for 2001 and 6.37%

for 2000

•Expected lives of 4.4, 4.9 and 5.6 years for 2002, 2001 and 2000,

respectively

•A dividend yield of zero for all three years

•Expected volatility of 40% for all three years

Revenue Recognition: Revenue is recognized at the point of sale

for retail transactions and at the time of successful delivery for contract,

catalog and Internet sales. An allowance for sales returns has been

recorded based on past experience. Revenue from sales of extended

warranty service plans is either recognized at the point of sale or over

the warranty period, depending on the determination of legal obligor

status. All performance obligations and risk of loss associated with such

contracts are transferred to an unrelated third-party administrator at

the time the contracts are sold. Costs associated with these contracts

are recognized in the same period as the related revenue.

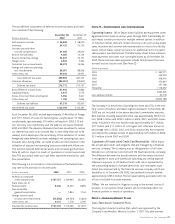

Shipping and Handling Fees and Costs: Income generated from

shipping and handling fees is classified as revenues for all periods pre-

sented. The costs related to shipping and handling are included as a

component of store and warehouse operating and selling expenses.

These costs were $717.8 million in 2002, $740.8 million in 2001 and

$747.8 million in 2000.

Advertising: Advertising costs are either charged to expense when

incurred or, in the case of direct marketing advertising, capitalized and

amortized in proportion to the related revenues. We participate in

cooperative advertising programs with our vendors in which they reim-

burse us for a portion of our advertising costs. Advertising expense, net

of cooperative advertising allowances, amounted to $317.6 million in

2002, $309.5 million in 2001 and $287.9 million in 2000.

Pre-Opening Expenses: Pre-opening expenses related to opening

new stores and warehouses or relocating existing stores and warehouses

are expensed as incurred and included in other operating expenses.

Self-Insurance: Office Depot is primarily self-insured for workers’

compensation, auto and general liability and employee medical insur-

ance programs. Self-insurance liabilities are based on claims filed and

estimates of claims incurred but not reported. These liabilities are not

discounted.

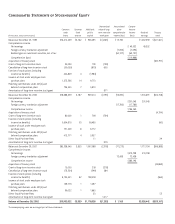

Comprehensive Income (Loss): Comprehensive income (loss) repre-

sents the change in stockholders’ equity from transactions and other

events and circumstances arising from non-stockholder sources. Compre-

hensive income (loss) consists of net earnings, foreign currency translation

adjustments and realized or unrealized gains (losses) on investment

securities that are available for sale, net of applicable income taxes.

Derivative Financial Instruments: Certain derivative financial instru-

ments may be used to hedge the exposure to foreign currency exchange

rate and interest rate risks, subject to established risk management

policies. Such approved financial instruments include swaps, options,

caps, forwards and futures. Use of derivative financial instruments for

trading or speculative purposes is prohibited by Company policies.

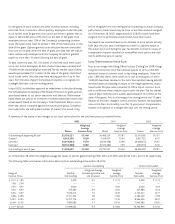

New Accounting Standards: In July 2001, the Financial Accounting

Standards Board (FASB) issued Statement No. 143, Accounting for Asset

Retirement Obligations. This Statement requires capitalizing asset retire-

ment costs as part of the total cost of the related long-lived asset and

subsequently allocating the total expense to future periods using a

systematic and rational method. Our adoption of this Statement, at the

beginning of fiscal year 2003, did not have a material impact on our

results of operations.

In April 2002, the FASB issued Statement No. 145, Rescission of FASB

Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and

Technical Correction. This Statement eliminates extraordinary account-

ing treatment for reporting gain or loss on debt extinguishment, and

amends other existing authoritative pronouncements to make various

technical corrections, clarify meanings, or describe their applicability

under changed conditions. Our adoption of this Statement, at the begin-

ning of fiscal year 2003, did not have a material impact on our results

of operations.

In June 2002, the FASB issued Statement No. 146, Accounting for Costs

Associated with Exit or Disposal Activities. This Statement requires record-

ing costs associated with exit or disposal activities at their fair values

when a liability has been incurred. Under previous guidance, certain exit

costs were accrued upon management’s commitment to an exit plan,

which is generally before an actual liability has been incurred. The adop-

tion of this Statement, at the beginning of fiscal year 2003 had no

immediate impact, but will affect the timing of future exit or disposal

activities reported by the Company.

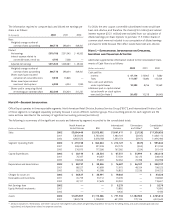

In November 2002, the FASB issued Interpretation 45, Guarantor’s

Accounting and Disclosure Requirements for Guarantees, Including Indi-

rect Guarantees of Indebtedness of Others. This Interpretation expands

the disclosures to be made by a guarantor about its obligations under

certain guarantees and requires that, at the inception of a guarantee, a

guarantor recognize a liability for the fair value of the obligation under-

taken in issuing the guarantee. The disclosure requirements are effective

immediately and are provided in Note H. The initial recognition and

measurement provisions of this Interpretation are effective for guaran-

tees issued or modified after December 31, 2002. We do not expect the

adoption of the initial recognition and measurement provisions of this

Interpretation to have a material impact on our results of operations.

In November 2002, the Emerging Issues Task Force (EITF) of the FASB

reached a consensus on EITF 02-16, Accounting by a Reseller for Cash

Consideration Received from a Vendor. Among other conclusions reached,

EITF 02-16 requires that consideration received from a vendor be pre-

sumed to be a reduction of the cost of the vendor’s products or services.

This presumption can be overcome if the consideration can be shown to

represent either a payment for assets or services delivered to the vendor

or a reimbursement of costs incurred by the reseller to sell the vendor’s

products. This treatment is effective for arrangements entered into or

modified on or after January 1, 2003. As stated above, cooperative

advertising programs offset a portion of our advertising costs. A change