Office Depot 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

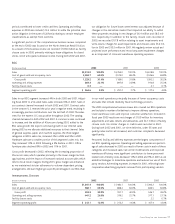

Sales in our International Division grew 11% in 2002 and 6% in 2001.

Adjusting fiscal 2000 to a 52-week basis, sales increased 8% in 2001.

Foreign currency translations increased sales reported in U.S. dollars in

2002 and decreased sales in U.S. dollars in 2001. Excluding the foreign

currency effect, sales in our International Division grew 6% in 2002 and

11% in 2001. Sales in 2002 reflect growth in all European countries

where we do business. During the year, we added catalog operations in

three countries, increased our contract sales force in four countries, initi-

ated contract sales in Italy, added a net of seven new stores in France,

made several changes to our Japanese operation and launched nine new

web sites. We expect to continue to grow each sales channel in our

European operations. Although the Office Depot姞brand continues to

grow as a percentage of the total sales in this segment, our Viking Office

Products姞brand still accounts for the vast majority of our international

business, representing approximately 86% of all international sales in

2002 and 87% in 2001. Competitive, political, and economic conditions

in international markets in which we operate may impact our sales and

profitability in the future. In addition, the prospects for conflicts in the

Gulf region of the Middle East may be expected to have an impact on

our international sales.

As noted above, sales in local currencies have substantially increased in

recent years. For U.S. reporting, these sales are translated into U.S. dollars

at average exchange rates experienced during the year. Future volatility

in exchange rates can affect translated sales and operating profit of our

International operations.

Gross profit as a percentage of sales decreased in 2002 as a result of

increased prospecting activity and the growth in our lower margin con-

tract business. During 2001, gross profit increased from pricing initia-

tives in certain machine and general office supply categories, partially

offset by the introduction of the contract sales channel in certain

European countries.

Operating and selling expenses as a percentage of sales are higher in our

International Division than in our other segments primarily because we

use an extensive marketing program to drive sales in existing markets,

particularly in our catalog business, and we have start-up activities in

several new markets. Similar to BSG, personnel and delivery expenses

are significant components of the International Division’s operating and

selling expenses. During 2002 and 2001, personnel, facility-related,

advertising, and delivery expenses increased because of the expansion of

our business in Europe. The impact of these increases was partially off-

set by continuing to leverage certain fixed operating expenses. As our

operations grow in a particular market, fixed operating expenses decline

relative to sales. For example, advertising costs in the form of prospecting

and delivery costs, which are affected by the density of the delivery

areas, decline as a percentage of sales as the market grows.

Fiscal 2001 includes a gain of $10.2 million from the sale of a London

warehouse, and fiscal 2000 includes charges of $2.2 million for facility

closure costs resulting from the 2000 comprehensive business review.

In August 2002, we decided to sell our operations in Australia. We con-

ducted an auction offering of the business and reached agreement with a

purchaser in December 2002. We closed the transaction in early January

2003 with no significant impact on earnings. The Australian operations

have been accounted for as discontinued operations and all periods pre-

sented have been restated. In addition to Europe, operations continue in

Japan. We have focused the Japanese business on a single brand offering

and streamlined operations; however, sales trends in Japan have been

negative for each of the periods presented.

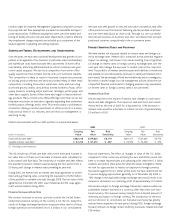

Corporate and Other

Pre-Opening Expenses

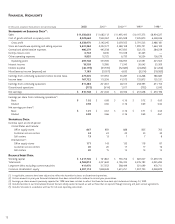

(Dollars in thousands) 2002 2001 2000

Pre-opening expenses $8,414 $10,172 $13,465

Office supply stores opened* 42 55 78

* Includes domestic and wholly owned international openings and relocations.

Our pre-opening expenses consist principally of personnel, property and

advertising expenses incurred in opening or relocating stores in our

North American Retail Division. Our pre-opening expenses also include,

to a lesser extent, expenses incurred to open or relocate facilities in

our BSG and International Division. We typically incur pre-opening

expenses during a six-week period prior to a store opening. Because we

expense these items as they are incurred, the amount of pre-opening

expenses each year is generally proportional to the number of new stores

opened during the period. This has been the primary contribution to the

fluctuation in pre-opening expenses over the three years presented. For

2002, our pre-opening expenses approximated $165,000 per domestic

office supply store and $115,000 per international office supply store.

Our cost to open a new CSC varies significantly with the size and

location of the facility. We currently estimate costs to open a domestic

or international CSC to be approximately $1.0 million per facility.

General and Administrative Expenses

(Dollars in thousands) 2002 2001 2000

General and administrative expenses $486,279 $445,538 $447,693

Percentage of sales 4.3% 4.0% 3.9%

Our general and administrative expenses consist primarily of personnel-

related costs associated with support functions. Because these functions

typically support all segments of our business, we do not consider these

costs in determining our segment profitability. The increase in 2002

reflects additional professional fees to support operational process

improvements, additional benefits costs, and costs incurred to support

expansion activities that were not chargeable to segment operations. As

noted above, other companies may charge more or less of their general

and administrative costs to their segments, and comparisons to their

operations could be affected.

Other Income and Expense

(Dollars in thousands) 2002 2001 2000

Interest income $ 18,509 $ 12,980 $ 11,345

Interest expense (46,195) (43,339) (32,683)

Miscellaneous income (expense), net 7,183 (9,057) 4,632

Financing and investing activities are not included in determining seg-

ment profitability. Average cash balances increased during 2001 and

2002, contributing to the increase in interest income; however, interest

rates declined during the same time period, somewhat offsetting the