Office Depot 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Office Depot, Inc. and Subsidiaries

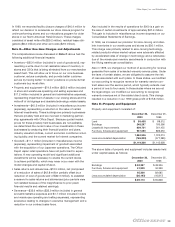

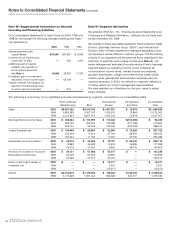

Amounts included in “Eliminations and Other” consist of

the following:

Sales consist of inter-segment sales, which are generally

recorded at the cost to the selling entity.

Earnings Before Income Taxes are primarily associated with

corporate activities and are detailed below:

2000 1999 1998

General and

administrative expenses $501,700 $381,611 $330,194

Net gain on

investment securities (12,414) ——

Interest (income) expense, net 22,399 (4,028) (2,953)

Inter-segment transactions 257 183 415

Other, net 317 ——

Total $512,259 $377,766 $327,656

Capital Expenditures, Depreciation and Amortization, and Assets

are also related primarily to our corporate activities.

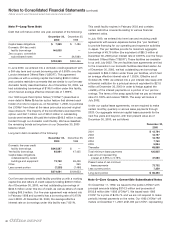

We have operations, either owned directly or operated through

joint ventures or licensing arrangements, in Australia, Austria,

Belgium, Canada, France, Germany, Hungary, Ireland, Israel,

Italy, Japan, Luxembourg, Mexico, the Netherlands, Poland,

Thailand, the United Kingdom, and the United States. Also from

1993 through the fourth quarter of 2000, we had operations in

Colombia under a licensing agreement. There is no single coun-

try outside of the United States in which we generate 10% or

more of our total revenues. Summarized financial information

relating to our operations is as follows:

Sales

2000 1999 1998

United States $ 9,901,975 $ 8,743,428 $7,765,714

International 1,667,721 1,528,632 1,241,337

Total $11,569,696 $10,272,060 $9,007,051

Assets

2000 1999

United States $ 3,391,678 $ 3,512,442

International 804,656 763,741

Total $ 4,196,334 $ 4,276,183

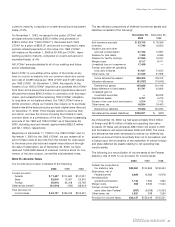

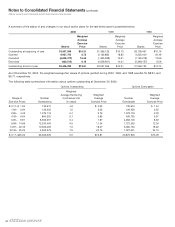

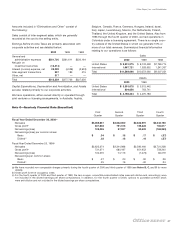

Note O—Quarterly Financial Data (Unaudited)

First Second Third Fourth

Quarter Quarter Quarter Quarter

Fiscal Year Ended December 30, 2000(a)

Net sales $3,065,657 $2,632,850 $2,822,991 $3,048,198

Gross profit(b) 837,646 751,513 735,222 765,617

Net earnings (loss) 109,036 57,937 50,622 (168,263)

Net earnings (loss) per common share:

Basic $ .34 $ .18 $ .17 $ (.57)

Diluted(c) .32 .18 .16 (.57)

Fiscal Year Ended December 25, 1999(a)

Net sales $2,625,374 $2,344,988 $2,580,460 $2,721,238

Gross profit(b) 731,371 680,187 651,952 758,240

Net earnings (loss) 100,576 74,116 (1,073) 84,019

Net earnings per common share:

Basic $ .27 $ .20 $ .00 $ .26

Diluted(c) .25 .19 .00 .24

(a) We have recorded non-comparable charges primarily during the fourth quarter of 2000 and third quarter of 1999 (see Notes B, C, and Dfor more

details).

(b) Gross profit is net of occupancy costs.

(c) For the fourth quarter of 2000 and third quarter of 1999, the zero coupon, convertible subordinated notes were anti-dilutive and, accordingly, were

not included in the diluted earnings per share computations. In addition, for the fourth quarter of 2000, options to purchase common stock

were anti-dilutive and not included in the diluted earnings per share computations.