Office Depot 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

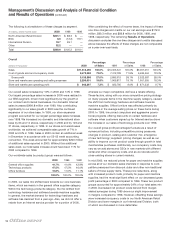

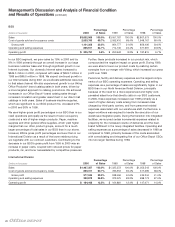

Management’s Discussion and Analysis of Financial Condition

and Results of Operations (continued)

In July 1999, we entered into term loan and revolving credit

agreements with several Japanese banks (the “yen facilities”)

to provide financing for our operating and expansion activities

in Japan. The yen facilities provide for maximum aggregate

borrowings of ¥9.76 billion (the equivalent of $85.3 million at

December 30, 2000) at an interest rate of 0.875% over the Tokyo

Interbank Offered Rate (“TIBOR”). These facilities are available

to us until July 2002. The yen facilities loan agreements are tied

to the covenants in our domestic facilities described earlier. As

of December 30, 2000, we had outstanding yen borrowings

equivalent to $64.0 million under these yen facilities, with an

average effective interest rate of 1.252%. Effective October 28,

1999, we entered into a yen interest rate swap with a financial

institution for a principal amount equivalent to $21 million at

December 30, 2000 in order to hedge against the volatility of the

interest payments on a portion of our yen borrowings. The terms

of the swap specify that we pay an interest rate of 0.700% and

receive TIBOR. The swap will mature in July 2002.

In addition to bank borrowings, we have historically used equity

capital, convertible debt and capital equipment leases as sup-

plemental sources of funds.

In August 1999, our Board approved a $500 million stock

repurchase program reflecting its belief that our common stock

represented a significant value at its then-current trading price.

We purchased 46.7 million shares of our stock at a total cost of

$500 million plus commissions during the third and fourth quar-

ters of 1999. During the first half of 2000, our Board approved

additional stock repurchases of up to $300 million, bringing our

total authorization to $800 million. We completed these programs

during 2000, purchasing an additional 35.4 million shares of our

stock at a total cost of $300 million plus commissions.

In 1992 and 1993, we issued Liquid Yield Option Notes

(“LYONsT”) which are zero coupon, convertible subordinated

notes maturing in 2007 and 2008, respectively. Each LYONT

is convertible at the option of the holder at any time on or prior

to its maturity into Office Depot common stock at conversion

rates of 43.895 and 31.851 shares per 1992 and 1993 LYONT,

respectively. On November 1, 2000, the majority of the holders

of our 1993 LYONsTrequired us to purchase the LYONsTfrom

them at the issue price plus accrued original issue discount.

We paid the holders $249.2 million in connection with this repur-

chase, and reclassified the remaining 1993 LYONsTobligation

to long-term on our balance sheet. Our 1992 LYONsThas a

similar provision whereby the holders may require us to purchase

these notes at the issue price plus accrued original issue dis-

count on December 11, 2002. If the holder decides to exercise

their put option, we have the choice of paying the holder in

cash, common stock or a combination of the two.

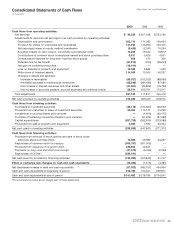

Our stock repurchase and the repurchase of our 1993 LYONsT

make up the majority of cash used in financing activities for

2000. We began borrowing from our domestic credit facilities

during the fourth quarter of 2000, primarily to fund the LYONsT

repurchase. The decline in cash from our financing activities in

1999, as compared to 1998, was driven by our stock repurchases.

We continually review our financing options. Although we cur-

rently anticipate that we will finance all of our 2001 expansion,

integration and other activities through cash on hand, funds

generated from operations, equipment leases and funds available

under our credit facilities, we will consider alternative financing

as appropriate for market conditions.

Significant Trends, Developments, and Uncertainties

Over the years, we have seen continued development and growth

of competitors in all segments of our business. In particular,

mass merchandisers and warehouse clubs have increased their

assortment of home office merchandise, attracting additional

back-to-school customers and year-round casual shoppers.

We also face competition from other office supply superstores

that compete directly with us in numerous markets. These other

office supply superstores compete with us in geographical loca-

tions where we have traditionally been the market leader, just as

we have begun penetrating markets where they have historically

held the dominant market share. This competition is likely to

result in increased competitive pressures on pricing, product

selection and services provided.

We have also seen growth in new and innovative competitors

that offer office products over the Internet, featuring special

purchase incentives and one-time deals (such as close-outs).

Through our own successful Internet and business-to-business

Web sites, we believe that we have positioned ourselves com-

petitively in the electronic commerce arena. We have invested

in strategic partnerships with several business-to-business

Internet companies offering innovative solutions to small

businesses, a target customer group. We are committed to

supporting our Internet channel to meet the needs of our

customers, including investing in new and innovative electronic

commerce business enterprises.