Office Depot 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

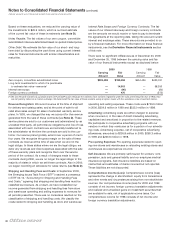

32

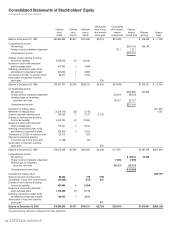

Consolidated Statements of Stockholders’ Equity

(In thousands, except share amounts)

Unamortized Accumulated

Common Common Additional value of long- other compre- Compre-

stock stock paid-in term incentive hensive hensive Retained Treasury

shares amount capital stock grant income (loss) income (loss) earnings stock

Balance at December 27, 1997 367,663,995 $3,677 $761,685 $(3,210) $(19,289) $ 976,525 $ (1,750)

Comprehensive income:

Net earnings $233,196 233,196

Foreign currency translation adjustment 1,211 1,211

Comprehensive income $234,407

Exercise of stock options (including

income tax benefits) 5,399,946 54 63,456

Issuance of stock under employee

stock purchase plans 467,394 4 7,896

Matching contributions under 401(k)

and deferred compensation plans 203,055 2 3,882

Conversion of LYONsTto common stock 83,314 1 1,203

Amortization of long-term incentive

stock grant 336

Balance at December 26, 1998 373,817,704 $3,738 $838,122 $(2,874) $(18,078) $1,209,721 $ (1,750)

Comprehensive income:

Net earnings $257,638 257,638

Foreign currency translation adjustment (28,319) (28,319)

Unrealized gain on investment

securities, net of tax 62,127 62,127

Comprehensive income $291,446

Acquisition of treasury stock (501,361)

Retirement of treasury stock (3,245,170) (32) (1,718) 1,750

Grant of long-term incentive stock 130,000 1 2,127 (2,127)

Exercise of stock options (including

income tax benefits) 4,457,024 45 72,865

Issuance of stock under employee

stock purchase plans 712,431 7 9,240

Matching contributions under 401(k)

and deferred compensation plans 320,906 3 5,423

Conversion of LYONsTto common stock 23,710 329

Payment for fractional shares in

connection with 3-for-2 stock split (4,166) (93)

Amortization of long-term incentive

stock grant 936

Balance at December 25, 1999 376,212,439 $3,762 $926,295 $(4,065) $ 15,730 $1,467,359 $(501,361)

Comprehensive income:

Net earnings $ 49,332 49,332

Foreign currency translation adjustment (7,093) (7,093)

Realized gain on investment

securities, net of tax (62,127) (62,127)

Comprehensive income (loss) $ (19,888)

Acquisition of treasury stock (300,797)

Grant of long-term incentive stock 25,000 199 (199)

Cancellation of long-term incentive stock (50,000) (819) 600

Exercise of stock options (including

income tax benefits) 424,809 4 (1,984)

Issuance of stock under employee

stock purchase plans 1,372,566 14 9,713

Matching contributions under 401(k)

and deferred compensation plans 703,545 7 5,810

Amortization of long-term incentive

stock grant 871

Balance at December 30, 2000 378,688,359 $3,787 $939,214 $(2,793) $(53,490) $1,516,691 $(802,158)

The accompanying notes are an integral part of these statements.