Office Depot 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

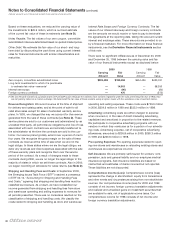

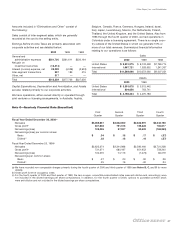

Notes to Consolidated Financial Statements (continued)

(Tabular amounts are in thousands except share and per share amounts)

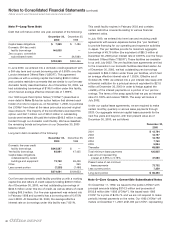

Note I—Commitments and Contingencies

Operating Leases: We lease facilities and equipment under

agreements that expire in various years through 2021. Substan-

tially all such leases contain provisions for multiple renewal

options. In addition to minimum rentals, we are required to pay

certain executory costs, such as real estate taxes, insurance

and common area maintenance, on most of our facility leases.

We are also required to pay additional rent on certain of our

facility leases if sales exceed a specified amount. The table

below shows you our future minimum lease payments due

under non-cancelable leases as of December 30, 2000. These

minimum lease payments do not include facility leases that

were accrued as merger and restructuring costs or store closure

and relocation costs (See Notes B and C).

2001 $ 352,328

2002 322,181

2003 271,476

2004 221,206

2005 188,692

Thereafter 929,490

2,285,373

Less sublease income 21,585

$2,263,788

We are in the process of opening new stores and CSCs in the

ordinary course of business, and leases signed subsequent to

December 30, 2000 are not included in the above described

commitment amounts. Rent expense, including equipment rental,

was approximately $393.5 million, $321.5 million and $249.2

million in 2000, 1999 and 1998, respectively. Included in this rent

expense was approximately $1.1 million, $0.8 million, and $1.1

million of contingent rent, otherwise known as percentage rent,

in 2000, 1999, and 1998, respectively. Rent expense was reduced

in 2000, 1999, and 1998 by sublease income of approximately

$3.0 million, $3.2 million, and $4.0 million, respectively.

Guarantee of Private Label Credit Card Receivables: We have

private label credit card programs that are managed by two

financial services companies. We are the guarantor of all loans

between our customers and the financial services companies.

Our maximum exposure to off-balance sheet credit risk is

represented by the outstanding balance of private label credit

card receivables, less reserves held by the financial services

companies which are funded by us. At December 30, 2000, this

exposure totaled approximately $239.2 million.

Other: We are involved in litigation arising in the normal course

of our business. In our opinion, these matters will not materially

affect our financial position or results of our operations.

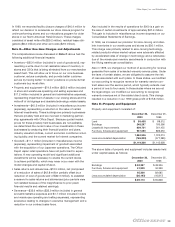

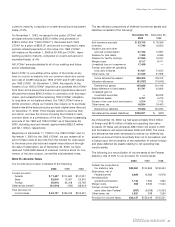

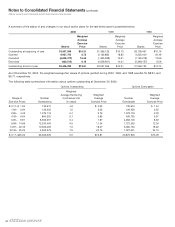

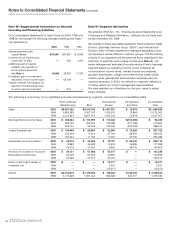

Note J—Employee Benefit Plans

Long-Term Equity Incentive Plan

Our Long-Term Equity Incentive Plan, which was approved

effective October 1, 1997, provides for the grants of stock

options and other incentive awards, including restricted stock,

to our directors, officers and key employees. When we merged

with Viking, their employee and director stock option plans were

terminated. When outstanding options issued under Viking’s

prior plans are exercised, Office Depot common stock is issued.

As of December 30, 2000, we had 55,807,052 shares of com-

mon stock reserved for issuance to directors, officers and key

employees under our Long-Term Equity Incentive Plan. Under

this plan, stock options must be granted at an option price that

is greater than or equal to the market price of the stock on the

date of the grant. If an employee owns at least 10% of our out-

standing common stock, the option price must be at least

110% of the market price on the date of the grant.

Options granted under this plan and options granted in July 1998

under Viking’s prior plans become exercisable from one to five

years after the date of grant, provided that the individual is

continuously employed with us. The vesting periods for all other

options granted under Viking’s prior plans were accelerated, and

the options became exercisable, as of the date of our merger

with Viking in August 1998. All options granted expire no more

than ten years from the date of grant.

Under this plan, we have also issued 236,193 shares of restricted

stock at no cost to the employees, 63,565 of which have been

canceled. The fair market value of these awards approximated

$3.0 million at the date of the grants. Common stock issued

under this plan is restricted, with vesting periods of up to four

years from the date of grant. We recognize compensation

expense over the vesting period.

We record an estimate of the tax benefit that we anticipate we

will receive based on the stock options exercised. Each year, we

adjust the prior year’s estimated tax benefit based on the actual

stock sold during the year. In 2000, this adjustment resulted in a

reduction of our estimated 1999 tax benefit and completely off-

set our 2000 estimated tax benefit (see Note M).

Long-Term Incentive Stock Plan

Viking had a Long-Term Incentive Stock Plan that, prior to the

merger, allowed Viking’s management to award up to 2,400,000

restricted shares of common stock to key Viking employees.

Under this plan, 1,845,000 shares were issued at no cost to

employees, 1,200,000 of which have been canceled. Pursuant

to the merger agreement, shares issued under this plan were

converted to Office Depot common stock, and no additional

shares may be issued under the plan. The fair market value of