Office Depot 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Office Depot, Inc. and Subsidiaries

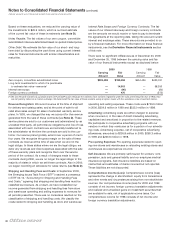

a yield to maturity, computed on a semi-annual bond equivalent

basis, of 5%.

On November 1, 1993, we issued to the public LYONsTwith

principal amounts totaling $345.0 million and proceeds of

$190.5 million (the “1993 LYONsT”). We issued each 1993

LYONTfor a price of $552.07, and we are not required to make

periodic interest payments on the notes. Our 1993 LYONsT

will mature on November 1, 2008 at $1,000 per LYONT, repre-

senting a yield to maturity, computed on a semi-annual bond

equivalent basis, of 4%.

All LYONsTare subordinated to all of our existing and future

senior indebtedness.

Each LYONTis convertible at the option of the holder at any

time on or prior to maturity into our common stock at a conver-

sion rate of 43.895 shares per 1992 LYONTand 31.851 shares

per 1993 LYONT. On November 1, 2000, the majority of the

holders of our 1993 LYONsTrequired us to purchase the LYONsT

from them at the issue price plus accrued original issue discount.

We paid the holders $249.2 million in connection with this repur-

chase, and reclassified the remaining 1993 LYONsTobligation

to long-term on our balance sheet. Our 1992 LYONsThave a

similar provision, where our holders may require us to purchase

these notes at the issue price plus accrued original issue discount,

on December 11, 2002. If the holders decide to exercise their

put option, we have the choice of paying the holders in cash,

common stock or a combination of the two. The total outstanding

amounts of the 1992 and 1993 LYONsTas of December 30,

2000, including accrued interest, approximated $222.3 million

and $2.1 million, respectively.

Beginning on December 11, 1996 for the 1992 LYONsTand on

November 1, 2000 for the 1993 LYONsT, we can redeem all or

part of these notes at any time from the holders for cash equal

to the issue price plus accrued original issue discount through

the date of redemption. As of December 30, 2000, we have

reserved 13,844,869 shares of unissued common stock for con-

version of the zero coupon, convertible subordinated notes.

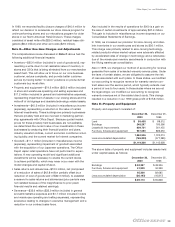

Note H—Income Taxes

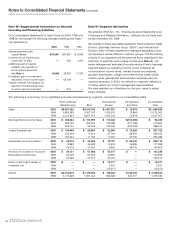

Our income tax provision consisted of the following:

2000 1999 1998

Current provision:

Federal $ 71,407 $114,800 $147,031

State 22,616 15,561 23,975

Foreign 30,918 26,318 22,769

Deferred tax benefit (81,814) (430) (38,244)

Total provision for

income taxes $ 43,127 $156,249 $155,531

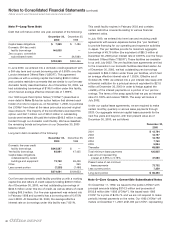

The tax-effected components of deferred income tax assets and

liabilities consisted of the following:

December 30, December 25,

2000 1999

Self insurance accruals $ 23,702 $ 18,366

Inventory 17,790 16,650

Vacation pay and other

accrued compensation 27,762 14,997

Reserve for bad debts 7,493 6,589

Reserve for facility closings 67,563 16,537

Merger costs 6,117 9,011

Unrealized loss on investments 17,499 —

Foreign and state net operating

loss carry forwards 91,037 74,645

Other items, net 27,343 21,958

Gross deferred tax assets 286,306 178,753

Valuation allowance (91,037) (74,645)

Deferred tax assets 195,269 104,108

Basis difference in fixed assets 51,797 42,806

Unrealized gain on

investment securities —39,222

Capitalized leases 5,757 5,275

Excess of tax over book amortization 1,214 1,172

Other items, net 16,294 16,460

Deferred tax liabilities 75,062 104,935

Net deferred tax assets (liabilities) $120,207 $ (827)

As of December 30, 2000, we had approximately $143 million

of foreign and $419 million of state net operating loss carry-

forwards. Of these carryforwards, $38 million will expire in 2001

and the balance will expire between 2002 and 2020. The valua-

tion allowance has been developed to reduce our deferred tax

asset to an amount that is more likely than not to be realized, and

is based upon the uncertainty of the realization of certain foreign

and state deferred tax assets relating to net operating loss

carryforwards.

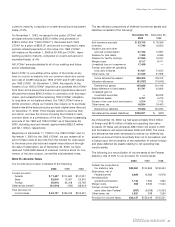

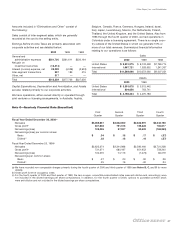

The following is a reconciliation of income taxes at the Federal

statutory rate of 35% to our provision for income taxes:

2000 1999 1998

Federal tax computed at

the statutory rate $32,361 $144,862 $136,054

State taxes, net of

Federal benefit 6,899 12,383 14,978

Nondeductible

goodwill amortization 1,744 1,964 1,990

Merger costs 969 2,920 11,044

Foreign income taxed at

rates other than Federal (667) (6,508) (10,061)

Other items, net 1,821 628 1,526

Provision for income taxes $43,127 $156,249 $155,531