Office Depot 2000 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2000 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Office Depot, Inc. and Subsidiaries

these restricted stock awards approximated $10.0 million at the

date of the grants. Prior to the merger, the vesting period was

15 years. Because of the plan’s change in control provision,

however, the employees now vest in their stock ratably over the

15-year period. Compensation expense is recognized over the

vesting period.

Employee Stock Purchase Plan

Our Employee Stock Purchase Plan, which was approved effec-

tive July 1999, replaces our prior plan and Viking’s plan and

permits eligible employees to purchase our common stock at

85% of its fair market value. The maximum aggregate number

of shares eligible for purchase under this plan is 3,125,000.

Other Stock-Based Compensation Plans

We have two stock-based compensation plans that are effective

in Australia and the United Kingdom. These plans allow eligible

employees to purchase up to 537,813 shares of common stock

at 80-85% of its fair market value.

Retirement Savings Plans

We have a 401(k) retirement savings plan which allows eligible

employees to contribute up to 18% of their salaries, commis-

sions and bonuses, up to $10,500 annually, to the plan on a

pretax basis in accordance with the provisions of Section 401(k)

of the Internal Revenue Code. We make matching contributions

of common stock into the plan that is equivalent to 50% of the

first 3% of an employee’s contributions. We may, at our option,

make discretionary matching common stock contributions in

addition to the normal match. We also have a deferred com-

pensation plan, which permits eligible employees to make

tax-deferred contributions of up to 18% of their salaries, com-

missions and bonuses to the plan. We make matching con-

tributions to the deferred compensation plan similar to those

under our 401(k) retirement savings plan described above.

Until April 2000, Viking had a separate profit sharing plan that

included a 401(k) plan that allowed eligible employees to make

pretax contributions. Under the profit sharing plan, we made

matching cash contributions of 25% of the first 6% of an

employee’s contributions. In April 2000, Viking’s profit sharing

plan was dissolved, and all plan funds were transferred into

Office Depot’s 401(k) retirement savings plan. Participants of

the old Viking plan, as well as all eligible Viking employees,

may now contribute to the Office Depot current 401(k) plan,

which is discussed in the above paragraph.

Accounting for Stock-Based Compensation

We apply Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” and related

Interpretations in accounting for our stock-based compensation

plans. The compensation cost that we have charged against

income for our Long-Term Equity Incentive Plan, Long-Term

Incentive Stock Plan, Employee Stock Purchase Plans and

retirement savings plans approximated $11.2 million, $12.5

million and $19.9 million in 2000, 1999 and 1998, respectively.

No other compensation costs have been recognized under our

stock-based compensation plans. Had compensation cost for

awards under our stock-based compensation plans been deter-

mined using the fair value method prescribed by SFAS No. 123,

“Accounting for Stock-Based Compensation,” our net earnings

and earnings per share would have been reduced to the pro

forma amounts presented below:

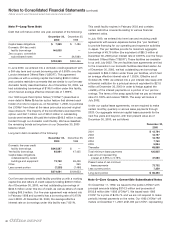

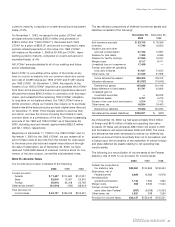

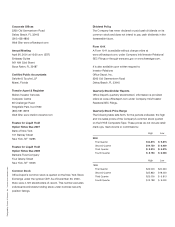

2000 1999 1998

Net earnings

As reported $49,332 $257,638 $233,196

Pro forma 11,253 226,424 184,916

Basic earnings per share

As reported $ 0.16 $ 0.71 $ 0.64

Pro forma 0.04 0.63 0.50

Diluted earnings per share

As reported $ 0.16 $ 0.69 $ 0.61

Pro forma 0.04 0.61 0.49

The fair value of each stock option granted is established on the

date of the grant using the Black-Scholes option pricing model

with the following weighted average assumptions for grants in

2000, 1999 and 1998:

• expected volatility rates of 40% for 2000, 35% for 1999, and

25% for 1998

• risk-free interest rates of 6.37% for 2000, 5.84% for 1999,

and 4.88% for 1998

• expected lives of 5.6, 5.6, and 5.0 years for 2000, 1999, and

1998, respectively

• a dividend yield of zero for all three years