Navy Federal Credit Union 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

52

2013 ANNUAL REPORT

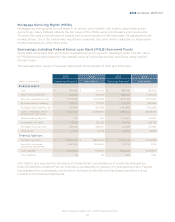

Mortgage Servicing Rights (MSRs)

Mortgage servicing rights do not trade in an active, open market with readily observable prices.

Accordingly, Navy Federal obtains the fair value of the MSRs using a third-party pricing provider.

The provider uses a combination of market and income valuation methodologies. All assumptions are

market driven. Once the preliminary results are complete, they are further calibrated to observable

market transactions, when they exist.

Borrowings, including Federal Home Loan Bank (FHLB) Borrowed Funds

FHLB debt comprises both short-term (operational) and long-term (strategic) debt. The fair value

of FHLB borrowings is based on the present value of future discounted cash flows using implied

forward rates.

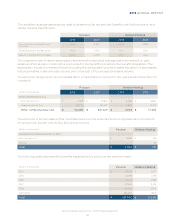

The estimated fair values of financial instruments at December 31, 2013 and 2012 were:

(dollars in thousands)

Cash $ 501,906 $ 501,906 $ 366,496 $ 366,496

Short-term investments 415,003 415,003 1,785,003 1,785,003

Securities available-for-sale 11,903,235 11,903,235 12,679,523 12,679,523

Securities held-to-maturity 377,034 377,012 469,752 485,490

Mortgage loans awaiting sale 507,948 507,948 1,442,868 1,442,868

Loans to members, net of

allowance for loan losses 38,977,357 43,822,134 33,180,033 38,725,919

Interest-bearing deposits 740 740 100,940 101,069

Investments in FHLBs 332,631 332,631 403,797 403,797

Mortgage servicing rights 236,579 236,579 144,089 144,089

Other assets 37,778 37,778 56,941 56,941

Members’ accounts $ 40,024,041 $ 38,562,152 $ 37,365,432 $ 37,013,982

Securities sold under

repurchase agreements 1,404,299 1,403,804 50,000 51,116

Notes payable 6,923,835 7,243,212 8,354,185 9,055,340

Other liabilities 131 131 7,597 7,597

ASC 825-10 also requires the disclosure of all significant concentrations of credit risk arising from

financial liabilities, whether from an individual counterparty or groups of counterparties. Navy Federal

has assessed the counterparty credit risk on its financial liabilities and has determined that it is not

material to the financial statements.