Navy Federal Credit Union 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

37

2013 ANNUAL REPORT

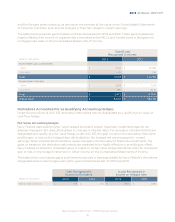

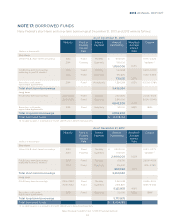

Member deposit accounts as of December 31, 2013 and 2012 were as follows:

(dollars in thousands)

Weighted-Average

Dividend Rate

for 2013

2013

Balance

Weighted-Average

Dividend Rate

for 2012

2012

Balance

Share and IRA certificates 2.10% $ 13,940,020 2.36% $ 13,887,953

Savings 0.25% 9,514,144 0.27% 8,436,922

Money market 0.54% 8,588,012 0.61% 7,672,947

Checking 0.16% 6,914,178 0.21% 6,217,947

IRA shares 0.25% 584,289 0.27% 517,224

IRA money market 0.53% 235,038 0.61% 176,471

Member escrow 0.07% 159,527 0.16% 143,181

Investor custodial accounts 0.00% 88,833 0.00% 312,787

Total deposits $ $

Overdrawn member accounts totaled $33.6 million and $23.7 million as of December 31, 2013 and

2012, respectively, and are classified as Accounts receivable in the Consolidated Statements of

Financial Condition.

The Helping Families Save Their Homes Act of 2009 provided $250,000 per account of share insurance

coverage through NCUSIF until December 31, 2013. As such, the total uninsured amount of members’

accounts was $3.1 billion and $2.8 billion at December 31, 2013 and 2012, respectively. Based on the

original insurance coverage of $100,000 per non-Individual Retirement Account (IRA) and $250,000

per IRA, the amount of members’ accounts exceeding the original coverage limits was $8.5 billion and

$7.7 billion at December 31, 2013 and 2012, respectively.

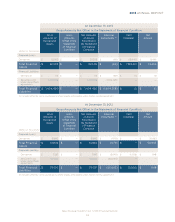

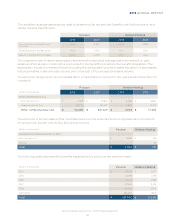

At December 31, 2013 and 2012, scheduled maturities of share certificates and IRA certificates were

as follows:

(dollars in

thousands)

Thereafter Total

0–1.00% $ 4,109,592 $ 396,111 $ 2,971 $ — $ 745 $ — $ 4,509,419

1.01–2.00 1,565,398 1,240,008 620,570 479,409 439,854 344,384 4,689,623

2.01–3.00 248,783 338,523 398,811 185,914 70,088 497,774 1,739,893

3.01–4.00 511,536 127,589 14,803 631,785 607,392 — 1,893,105

4.01–5.00 14,645 304,506 464,668 6,558 — — 790,377

5.01–6.00 317,282 23 — 11 — 19 317,335

6.01–7.00% 268 — — — — — 268

Total $ 6,767,504 $ 2,406,760 $ 1,501,823 $ 1,303,677 $ 1,118,079 $ 842,177 $ 13,940,020