Navy Federal Credit Union 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union • 2013 Financial Section

47

2013 ANNUAL REPORT

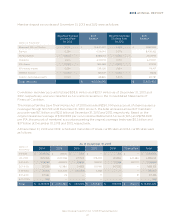

> Federal Agency Securities, Treasury Securities, Municipal Securities, and Bank Notes—Federal

agency securities, treasury securities, municipal securities, and bank notes are valued based on similar

assets in the marketplace and the vintage of the underlying collateral, or at the closing price reported in

the active market in which the individual security is traded.

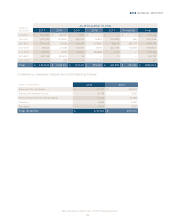

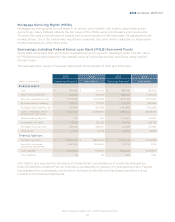

Mortgage Servicing Rights (MSRs)

MSRs do not trade in an active, open market with readily observable prices. Navy Federal obtains the fair

value of the MSRs using a third-party pricing provider. The provider uses a combination of market and

income valuation methodologies. All assumptions are market driven. Once the preliminary results are

complete, they are further calibrated to observable market transactions, when they exist. The valuation of

Navy Federal’s MSRs is model driven and primarily based on unobservable inputs and therefore classified

within Level 3 of the fair value hierarchy.

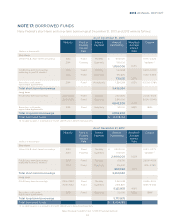

Derivative Assets and Liabilities

Fair values of Navy Federal’s interest rate swaps designated as cash flow hedges are determined based

on third-party models that calculate the net present value of the expected cash flows using LIBOR rate

curves, futures, basis spreads (when applicable), and OIS curves at each period end date. Counterparty

non-performance risk is considered by discounting future cash flows using OIS rates adjusted for credit

quality. Navy Federal also uses an internal process to further evaluate the risk of counterparty default.

Fair values of Navy Federal’s designated fair value hedges are determined by a third party using the

income approach, observable Level 2 market expectations at measurement date, and standard valuation

techniques to convert future amounts to a single discounted present amount in accordance with ASC

820-10. Quoted prices for similar assets or liabilities in active markets—specifically, futures contracts

on LIBOR, LIBOR cash and swap rates, and basis adjustments at commonly quoted intervals when

applicable—are used as the Level 2 inputs for the swap valuations. Mid-market pricing is used as a

practical expedient for fair value measurements.

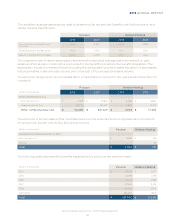

Fair values of Navy Federal’s IRLCs are determined based on an evaluation of best execution forward

contract prices sourced from the TBA market, adjusted by a factor that represents the probability it

will settle and become MLAS. IRLCs are classified as Level 2 in the fair value hierarchy.

Fair values of Navy Federal’s forward sales contracts on TBA securities are determined based on an

evaluation of best execution forward contract prices sourced from the TBA market, by agency. As such,

TBA hedges are classified as Level 2 in the fair value hierarchy.

Mortgage Loans Awaiting Sale (MLAS)

Mortgage loans awaiting sale comprise those loans that Navy Federal intends either to sell or to

securitize. The initial loan level basis is equal to unpaid principal balance plus or minus origination

costs and fees. Navy Federal has elected the fair value option for MLAS. The fair value of MLAS is

determined based on an evaluation of best execution forward sales contract prices sourced from the

TBA market, by agency (e.g., GNMA, FHLMC, and FNMA). As such, MLAS are classified as Level 2 in

the fair value hierarchy.

Real Estate Owned (REO)

Navy Federal acquires residential properties as a result of foreclosure or forfeiture, and those properties

are classified as REO properties. REOs are recognized at the lower of cost or fair value less costs to

sell. Navy Federal utilizes BPOs to estimate the fair market value of REOs. A BPO considers the value

of similar surrounding properties, sales trends in the neighborhood, an estimate of any of the costs

associated with getting the property ready for sale, and/or the cost of any needed repairs. Navy Federal

evaluates reasonableness by obtaining multiple BPOs on REO properties and also by analyzing significant