Navy Federal Credit Union 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union • 2013 Financial Section

27

2013 ANNUAL REPORT

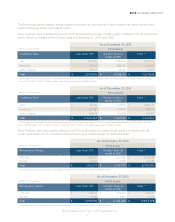

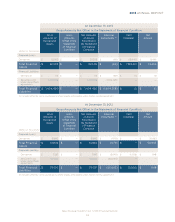

The sensitivities in the table above are hypothetical and may not be indicative of actual results. The

eect of a variation in a particular assumption on the fair value is calculated independently of changes in

other assumptions. Further, changes in fair value based on variations in assumptions generally cannot be

extrapolated because the relationship of the change in assumption on the fair value may not be linear.

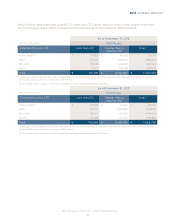

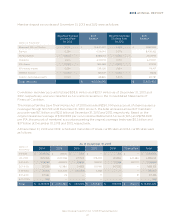

GNMA Valuation, Volume, and Delinquencies: Navy Federal uses a third party to value its GNMA

securities with a single cash flow stream model and market prices of similar assets. The fair value of

Navy Federal’s securitizations at December 31, 2013 and 2012 was $1.9 billion and $2.2 billion, respectively.

The UPB of the securitized loans was $2.2 billion at both December 31, 2013 and 2012. Delinquent

securitized loans totaled $0.04 million and $25.2 million at December 31, 2013 and 2012, respectively.

The fair value of the MSRs associated with securitized loans at December 31, 2013 and 2012 was

$5.9 million and $8.0 million, respectively.

GNMA Early Pool Buyback Program: Navy Federal has the option to repurchase pooled loans out of

GNMA securities when members fail to make payments for three consecutive months (via the GNMA

Early Pool Buyback Program). Since Navy Federal has the unilateral ability to repurchase these delinquent

loans, its eective control over the loans has been regained. Navy Federal recognizes an asset and a

corresponding liability at fair value, regardless of whether it has the actual intent to repurchase the loans.

At December 31, 2013 and 2012, balances recognized in Mortgage loans awaiting sale and Other liabilities

associated with the Early Pool Buyback Program totaled $22.7 million and $24.5 million, respectively.

Continuing involvement—recourse related

Representations and warranties: For mortgage loans transferred in sale transactions or securitizations

to FNMA, FHLMC, and GNMA, Navy Federal has made representations and warranties that the loans

meet their requirements. These requirements typically relate to collateral, underwriting standards,

validation of certain borrower representations in connection with the loan, and the use of standard legal

documentation. In connection with the sale of loans to FNMA, FHLMC, and GNMA, Navy Federal may

be required to repurchase loans or indemnify the respective entity for losses due to breaches of these

representations and warranties.

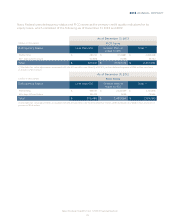

Navy Federal recognized a liability for estimated losses relating to representations and warranties from

the inception of the obligation when the loans are sold. This liability is included in Other liabilities on the

Consolidated Statements of Financial Condition. On the Consolidated Statements of Income, the related

provision expense is included as an oset to Net gains on mortgage loan sales for new loans sold during

the period, or in Loan servicing expenses for re-measurement of the liability on loans sold in prior periods.

Navy Federal’s estimated representations and warranties liability at December 31, 2013 was $24.9 million.

Management believes the recognized liability for representations and warranties appropriately

reflects the estimated probable losses on indemnification and repurchase claims for all loans sold and

outstanding as of December 31, 2013. In making these estimates, Navy Federal considers the losses

expected to be incurred over the life of the sold loans. While management seeks to obtain all relevant

information in estimating this liability, the estimation process is inherently uncertain and imprecise,

and accordingly, it is reasonably possible that future losses could be more or less than Navy Federal’s

established liability. At December 31, 2013, Navy Federal estimates that it is reasonably possible that it

could incur additional losses in excess of its accrued liability of up to approximately $42.5 million.

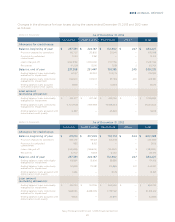

Charlie Mac Credit Enhancement: In February 2004, Navy Federal Credit Union entered into an

agreement with NFFG and Charlie Mac, LLC, an investor subsidiary of U.S. Central Credit Union,

under which Charlie Mac could purchase up to $200 million of credit-enhanced mortgage loans from

Navy Federal Credit Union and Navy Federal would retain the MSRs. Under the agreement, if a credit-

enhanced loan defaulted, Charlie Mac would recover the loan amount from NFFG. At inception,

Navy Federal’s maximum total exposure under the credit enhancement agreement was $8.5 million.