Navy Federal Credit Union 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union • 2013 Financial Section

12

2013 ANNUAL REPORT

Eective in Future Years

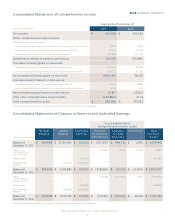

In February 2013, the FASB issued ASU 2013-02, Comprehensive Income (Topic 220): Reporting

of Amounts Reclassified out of Accumulated Other Comprehensive Income, eective for reporting

periods beginning after December 15, 2013 with early adoption permitted. This ASU requires entities

to disaggregate the total change in AOCI for the year by their corresponding net income components,

and the changes in AOCI must be broken down further between reclassification adjustments and

other changes during the period. Entities must also present significant reclassification adjustments by

component either on the face of the statement where net income is presented or as a separate disclosure

in the notes to the financial statements. This ASU is not expected to significantly impact Navy Federal’s

consolidated financial statements.

In January 2014, the FASB issued ASU 2014-04, Receivables—Troubled Debt Restructurings by Creditors

(Subtopic 310-40): Reclassification of Residential Real Estate Collateralized Consumer Mortgage Loans

upon Foreclosure. This ASU clarifies when a creditor should be considered to have received physical

possession of residential real estate property collateralizing a consumer mortgage loan, such that the

loan should be derecognized and the real estate property recognized. This ASU, eective for reporting

periods beginning after December 15, 2014, is not expected to significantly impact Navy Federal’s

consolidated financial statements.

In February 2013, the FASB issued ASU 2013-04, Liabilities (Topic 405): Obligations Resulting from Joint

and Several Liability Arrangements for Which the Total Amount of the Obligation is Fixed at the Reporting

Date, which requires entities to measure obligations resulting from joint and several liability arrangements

for which the total amount of the obligation is fixed at the reporting date, as the sum of the amount the

reporting entity agreed to pay on the basis of its arrangement among its co-obligors and any additional

amount the reporting entity expects to pay on behalf of its co-obligors. Required disclosures include a

description of the joint-and-several arrangement and the total outstanding amount of the obligation for

all joint parties. These disclosure requirements are incremental to the existing related-party disclosure

requirements in ASC 850, Related Party Transactions. For non-public entities, the ASU is eective for

the first annual period ending on or after December 15, 2014, with early adoption permitted. This ASU

is not expected to significantly impact Navy Federal’s consolidated financial statements.

NOTE 2:

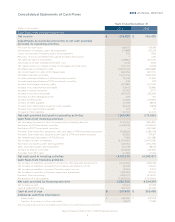

NFFG had $2.8 million and $1.0 million in restricted cash at December 31, 2013 and 2012, respectively,

as part of its original agreement with Charlie Mac, LLC. See Note 8 for details.

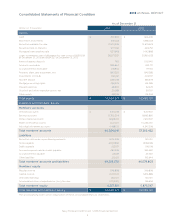

All restricted cash amounts are classified as Other assets on the Consolidated Statements of

Financial Condition.