Navy Federal Credit Union 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

26

2013 ANNUAL REPORT

NOTE 8:

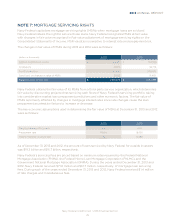

Navy Federal may have continuing involvement in residential mortgage loans that it has transferred

in sale transactions or securitizations through retained servicing, investment, indemnification against

credit losses, or provisions that allow or require the transferred loans to be reacquired.

Navy Federal originates and sells mortgage loans to FNMA and FHLMC, who securitize those loans

through special purpose entities into mortgage-backed securities, which are sold on the secondary

market to third-party investors.

Navy Federal also originates and securitizes qualifying mortgage loans into GNMA mortgage-backed

securities that are either sold to third-party investors or retained by Navy Federal for investment.

Prior to securitization, all loans to be transferred in sale transactions or securitizations are classified

as MLAS.

Continuing involvement—non-recourse related

Servicing: Navy Federal retains mortgage servicing rights on loans transferred in sale transactions or

securitizations. See Note 7 for details.

Retained investment in GNMA securities: GNMA securities backed by Navy Federal loans may be

retained by Navy Federal and held in the AFS portfolio for investment. AFS investments are carried at

fair value with changes in fair value recorded in AOCI. See Note 3 for details.

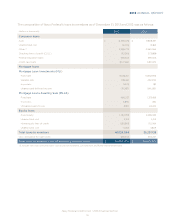

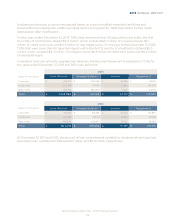

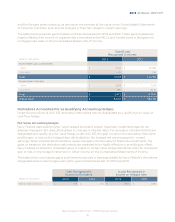

In accordance with ASC 860-20, Secured Borrowing and Collateral, the eect of two negative changes in

each of the key assumptions used to determine the fair value of Navy Federal’s retained interest in GNMA

securities must be disclosed. The negative eect of each key assumption change must be calculated

independently, holding all other assumptions constant. The first table below details the key assumptions

used in Navy Federal’s analysis—specifically, constant prepayment rate (CPR), anticipated credit losses,

and weighted-average life. The second table below details the potential impacts on the fair value of the

securities of 10 percent and 20 percent adverse changes to the CPR.

Weighted-average constant prepayment rate (CPR) (1) 7.8% 8.6%

Anticipated credit losses (2) 0 0

Weighted-average life (years) 5.96 6.28

(1) CPR is based on the average of the CPR for all GNMA securities.

(2) GNMA securities are collateralized by government-insured loans, and there is no anticipation of significant credit losses.

(dollars in thousands)

Constant prepayment rate

Adverse fair value change of 10% $ 1,687 $ 7,166

Adverse fair value change of 20% 3,528 13,929