Navy Federal Credit Union 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

14

2013 ANNUAL REPORT

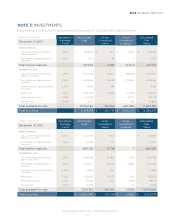

Navy Federal sold $3.5 billion and $2.0 billion of AFS securities during the years ended December 31,

2013 and 2012, respectively. Gross proceeds from those sales totaled $3.5 billion and $2.1 billion for the

years ended December 31, 2013 and 2012, respectively. Gross realized gains of $49.6 million and gross

realized losses of $32.8 million were included in earnings for the year ended December 31, 2013. Gross

realized gains of $42.6 million and gross realized losses of $2.0 million were included in earnings for the

year ended December 31, 2012.

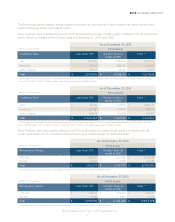

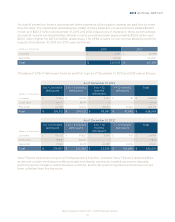

The maturities of Navy Federal’s securities as of December 31, 2013 and 2012 were as follows:

(dollars in thousands) Amortized Cost

Due in one year or less $ 285,758 $ 289,430

Due after one year through five years 4,492,719 4,595,540

Due after five years through ten years 2,297,816 2,221,952

Due after ten years 5,302,525 5,173,325

$ $

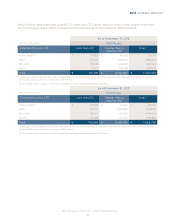

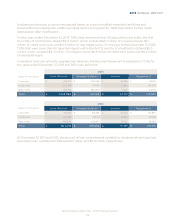

(dollars in thousands) Amortized Cost

Due in one year or less $ 489,599 $ 495,428

Due after one year through five years 4,170,393 4,397,135

Due after five years through ten years 3,363,763 3,506,540

Due after ten years 4,603,191 4,765,910

$ $

Navy Federal held $332.6 million and $403.8 million, respectively, of stock in the Federal Home Loan

Bank (FHLB) of San Francisco and the FHLB of Atlanta as of December 31, 2013 and 2012. FHLB stock is

a restricted investment carried at cost and evaluated for impairment. As a member of the FHLB system,

Navy Federal has access to a $9.9 billion line of credit facility.

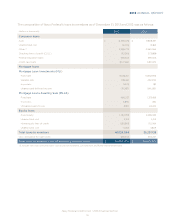

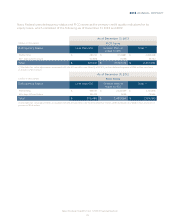

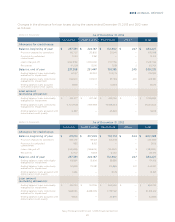

All debt securities in an unrealized loss position were reviewed individually to determine whether

those losses were caused by an other-than-temporary decline in fair value. Navy Federal makes a

determination of whether unrealized losses are other-than-temporary based on the following factors:

whether Navy Federal intends to sell or hold the security until its costs can be recovered, the nature

of the security, the portion of unrealized losses that are attributable to credit losses, and the financial

condition of the issuer of the security. Navy Federal does not intend to sell nor would Navy Federal

be, more likely than not, required to sell these securities before recovering its amortized cost basis.

The unrealized losses associated with these investments are not a result of a change in the credit

quality of the issuer; rather, the losses are reflective of changing market interest rates. Therefore,

Navy Federal expects to recover the entire cost basis of these securities.